CBK (Central Bank of Kenya), the Kenya Government’s fiscal agent, accepted bids worth KSh 54.8 Billion at Wednesday’s Treasury Bonds Auction, rejecting more expensive bids worth KSh 61.1 Billion.

The Government had sought KSh 40 billion for budgetary support, through the sale of these two long-term paper

This week’s CBK Auction of the reopened two long-term bonds received an overwhelming subscription of total bids worth KSh 115.9 Billion, a near threefold oversubscription rate of 289.65%. Results show an investors rush for the 25-year Treasury Bond that was first sold in 2022, which had an attractive coupon rate of 14.19% and matures after 14.2 years.

The 15-year Treasury Bond, on the other hand, has a coupon rate of 12.34 and is having the first reopening after it was first sold in 2019, with a maturity of 8.7 years.

The total outstanding amount for these two papers is KSh 195.0billion, with the 25-year paper taking the largest share of KSh 141.1billion. The sale period for both papers ended on Wednesday 19th November 2025.

Analysts attribute the huge investor demand in these papers to their attractive coupon rates, especially the 25-year Treasury Bond which had a return of 14.19%.

CBK was simultaneously active in the bonds market

CBK was conducting this auction while also making payments to investors who had successful bids in the just concluded KSh 30 billion Treasury Bonds Buyback issue that saw the fiscal agent redeem KSh 20.1 Billion from the KSh 30 Billion 3-year Bond that matures in May 2026. The paper had an outstanding amount of KSh 76.6 Billion.

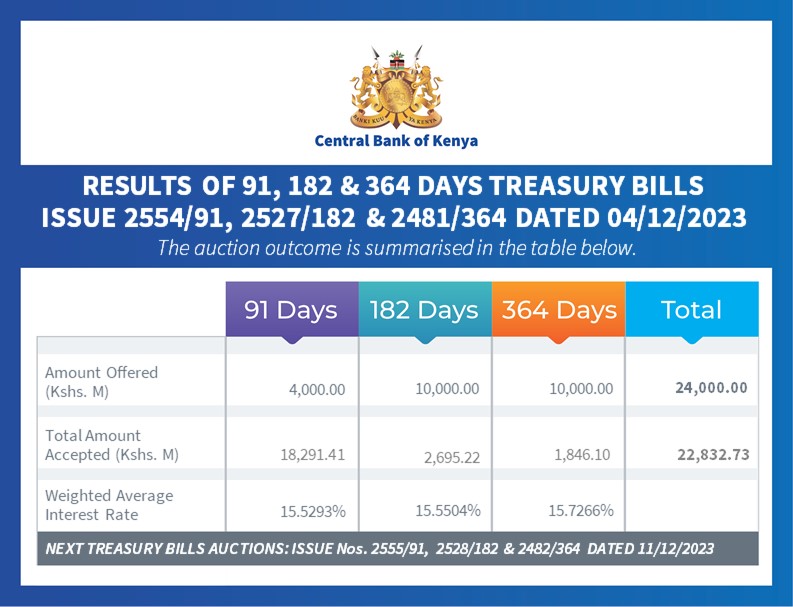

ALSO READ: LATEST CBK TREASURY BILLS AUCTION RESULTS:

CBK figures show that turnover in the secondary bond market, rose to KSh 55.9billion last week from KSh 40.9bn the week prior.

CBK conducted this month’s first Treasury Bonds Auction on Wednesday 5th, seeking KSh 40 billion for Budgetary support. The state fiscal agent accepted bids worth KSh 52.8 billion and rejected KSh 43.4 billion.

ALSO READ:CBK Raises KSh 52.8 Bn for Budget Support in November

![President William Ruto during the launch of Climate WorX in Nairobi. [Photo/PCS]](https://businesstoday.co.ke/wp-content/uploads/2024/10/President-William-Ruto-during-the-launch-of-Climate-WorX-in-Nairobi-1-e1727761613802.png)

![Pula Co-Founders and Co-CEOs, Rose Goslinga & Thomas Njeru. Pula provides agricultural insurance and digital products to help smallholder farmers manage climate risks, improve farming practices and increase their incomes. [ Photo / Courtesy ]](https://businesstoday.co.ke/wp-content/uploads/2021/01/Pula-Co-Founders-and-Co-CEOs-Thomas-Njeru-Rose-Goslinga.jpg)

Leave a comment