NAIROBi, Kenya

Cooperative Bank of Kenya has completed its implementation of Misys BankFusion – a transformation platform to support the bank’s rapid expansion plans. Since implementation, the bank’s profits have increased 31 percent to Ksh 3.23 bi*lion, for the first quarter of 2013.

Transaction processing throughput has doubled and end-of-day processing has improved by 40%. The bank has 3.4 mi*lion custom**s and is looking to grow this considerably over the next twelve months through superior customer service and an extended branch network able to serve its custom**s more effectively. Misys BankFusion provides the innovation platform for Cooperative Bank of Kenya’s ambitious growth plans.

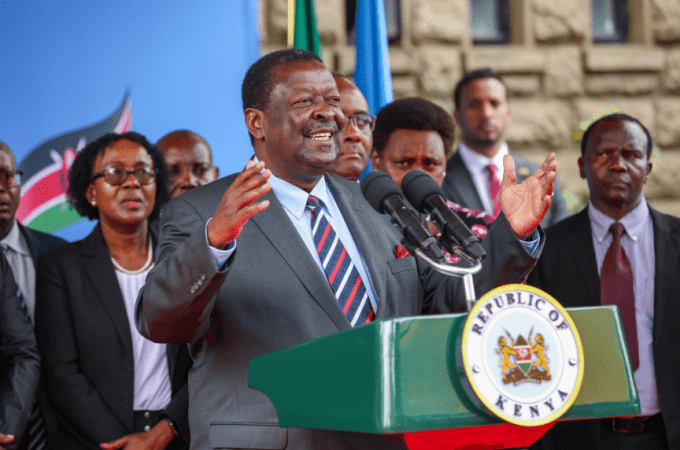

As well as replacing the core system, the bank has adopted new front-office products from Misys, including the BankFusion Applications: BankFusion Teller, BankFusion Loan Origination and BankFusion Party which provides a single customer view. “Misys BankFusion is the most innovative and technologically advanced core banking platform on the market,” states Dr. Gideon Muriuki, Group Managing Director and CEO at Cooperative Bank of Kenya.

“We evaluated several vendor offerings and none came close to the flexibility that BankFusion provides. We have ambitious growth plans to increase our market share in Kenya and also expand into new territories such as South Sudan. We are confident that the combination of Misys BankFusion core banking system, and the new BankFusion Applications in the front office, wi*l accelerate our ability to grow. Beyond its market-leading technology, Misys is well known for its strong track record of delivering quality implementations, and the team at Misys has delivered on this commitment.”

Cooperative Bank of Kenya is among 70 banks that have adopted Misys BankFusion. Nadeem Syed, CEO, Misys said: “Cooperative Bank of Kenya is one of the most ambitious banks in Africa. It is operating in a highly compet*tive market, with international entrants disrupting the banking industry there. To create differentiation and capture further market share, the bank has taken a pioneering approach to technology adoption and was one of the first banks in Africa to embrace mobile banking. With Misys BankFusion, Cooperative Bank of Kenya has selected a flexible technology platform, built for the future.”

This has given Cooperative Bank of Kenya the confidence to launch operations in South Sudan, where it has already signed a contract to implement BankFusion. In selecting Misys as its strategic IT partner, the bank has bought into the Misys vision and roadmap for banking. With an eye on further expansion into Uganda and Rwanda, and with Misys as its strategic IT partner, Cooperative Bank of Kenya is well positioned to capitalise on growth opportunities and accelerate into these new markets.

Leave a comment