KCB Bank plans to deepen its youth proposition in the coming year by rolling out a series of targeted financial solutions, riding on its revamped digital platform.

Under its flagship KCB Bankika Account, the Bank said it hopes to deepen its financial inclusion agenda for the youth as its next frontier for growth. This was disclosed by the Bank’s Marketing and Communications Director Angela Mwirigi when the lender awarded at least 800 winners of its just concluded Bankika Ushinde Campaign.

“As part of our deliberate investments towards supporting the youth agenda, we have anchored our growth strategy on providing a targeted one-stop shop financial that is formed around a digital finance,” said Ms Mwirigi. “The youth are the future and we are glad that we are playing a positive role in promoting a savings culture among the young people,”

A total of 800 winners for the Bankika Ushinde promotion received cash prizes totaling Kshs5.75 million. The 3 overall winners received a combined total of Kshs1.75 million.

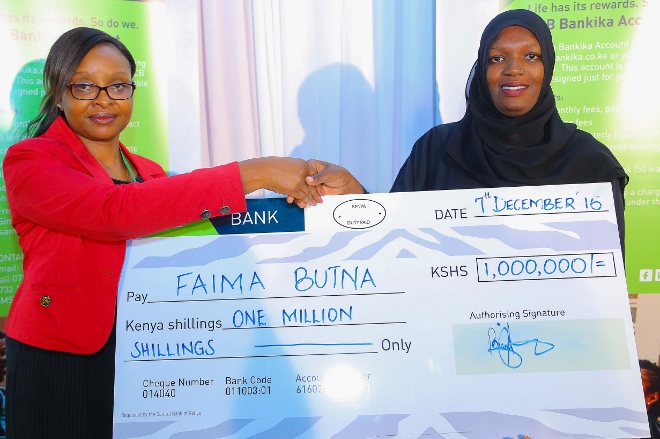

Kennedy Kamau Gacheru, Judy Makena Mutwiri and Faima Butna won Sh 250,000, Sh 500,000 and Sh1 million respectively.

During campaign, the bank saw Bankika personal accounts rise by 25% while the Bankika Business accounts shot up 39%. The value of deposits in the Bankika personal and business accounts also rose by 25% and 135% respectively. “This is part of the bank’s strategy to bank the unbanked within our society and to promote financial inclusion” she added.

As part of its youth agenda, the Bank has sponsored the reality TV show — KCB Lion’s Den — the first of its kind in Kenya, targeting entrepreneurs who have good business ideas with a concrete business plan and those who have an established business but need to raise funds to advance their business further.

The Bank has simplified the process of account opening for the youth, allowing for access through online banking and mobile banking services which can all be done in the comfort of their homes.

[crp]

![Pula Co-Founders and Co-CEOs, Rose Goslinga & Thomas Njeru. Pula provides agricultural insurance and digital products to help smallholder farmers manage climate risks, improve farming practices and increase their incomes. [ Photo / Courtesy ]](https://businesstoday.co.ke/wp-content/uploads/2021/01/Pula-Co-Founders-and-Co-CEOs-Thomas-Njeru-Rose-Goslinga.jpg)

Leave a comment