KCB Bank has revamped its mobile banking application to enhance its capabilities and guarantee tighter security features as it deepens its banking agenda.

The app that first rolled out on April of 2015 has now been actively used and with reaches in countries as Uganda, Tanzania, Burundi, Rwanda, Ethiopia and S. Sudan is one of the best ranked apps on Google play store.

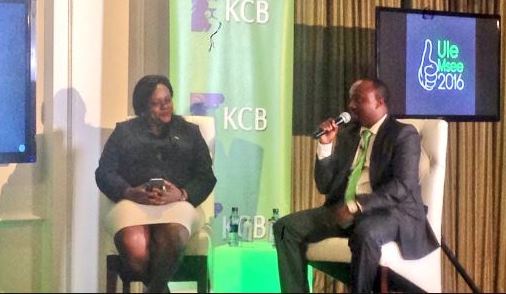

“With the new look, KCB Bank is looking forward to completely change the customer service feeling on the platform” said the Head of Electronic Payments at KCB Bank Group Mr Johnson Ondichu. “We foresee transformation because the app is determined to solve the little problems the users encounter.”

The KCB App, which is available in all the seven markets KCB operates in, now boasts a solid encryption that is set to safeguard and protect customer details (identity & financial information). Among the many upgrades, the app has improved user interface for all platforms and with all financial inclusion set in one place.

[crp]

This includes a KCB M-Pesa transaction that is inbuilt and easy to add recipient contact directly from the source. An improved financial tagging system, which allows user to view financial statistics, is also available. The bank has also made bank transfers swift and easy by adding a sorted directory of bank codes /addresses.

Among the many upgrades are bill payments. The app converges all activities giving an opportunity to be able store user history on bill payments for future use, which apart from making the work load lighter; it reduces the chances of making errors.

Fees payment has also been made easier. The app has uploaded all school accounts; this reduces queuing to make payments at the bank by 100%. “This intuitive app is focused to organise and manage all you financial information in an easy way” added the marketing director at KCB, Mrs Angela Mwirigi. “The app lets users to create new accounts directly from the app.”

KCB says there are about 20,000 transactions daily on the new app. They expect a rapid growth to have at least 9 million accounts accessible on this app. Sources say that over 33% of their transactions this year are on this app.

Wilson Muirani, known for his comedy name Jaymoh ule Mse was also present at the launch. Muirani, the “Hon minister of Finance Mtaani”, said the app will solve most of the challenges being faced by young entrepreneurs in the current banking systems. The solutions will include time management by having a bank branch on the app, financial management and financial emergencies.

He encouraged KCB customers to take advantage of this new service. “We believe that the future is digital. It is all about better security and better service,” added KCB Chief Operating Officer, Sam Makome, “We also wish to partner with young innovators and app developers to grow this technology not for the bank but for the future of all.”

![Pula Co-Founders and Co-CEOs, Rose Goslinga & Thomas Njeru. Pula provides agricultural insurance and digital products to help smallholder farmers manage climate risks, improve farming practices and increase their incomes. [ Photo / Courtesy ]](https://businesstoday.co.ke/wp-content/uploads/2021/01/Pula-Co-Founders-and-Co-CEOs-Thomas-Njeru-Rose-Goslinga.jpg)

Leave a comment