Farmers can now have a peace of mind after Acre Africa, a regional micro-insurance firm, launched its operations in Kenya. It will provide insurance cover to smallholder farmers against climate-associated risk.

The firm intends to invest across the agricultural value chain, in partnership with other players, to develop localised solutions that reduce risk and unlock the potential of agriculture in Kenya. It already operates in Rwanda and Tanzania.

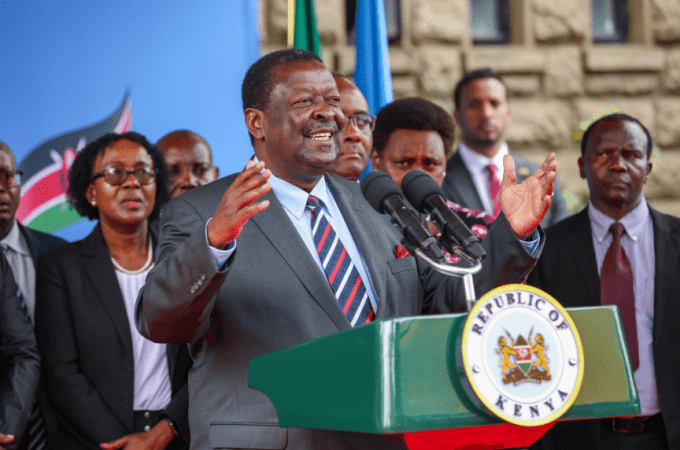

Speaking during the launch, Mr Marco Ferroni, Chairman, Acre Africa said that provision of insurance covers to farmers would support growth of the agricultural sector in Kenya.

“The agricultural sector is Kenya’s main economic mainstay. Provision of insurance covers to farmers against the vagaries of weather and other risks will boost agricultural output,” added Mr Ferroni.

The CEO of Acre Africa, Dr CJ Jones said that by designing products that cushion farmers against stress and potential damage from climate variables, it would help inspire a new generation of farmers across Africa, thus unlocking the full potential of agriculture.

“We are determined to champion a paradigm shift towards equity, fairness and innovation in the agricultural sector. Majority of the farmers are small holder farmers. The agriculture insurance market in Kenya focuses mainly on large scale farmers, therefore Acre Africa seeks to address this problem by developing insurance products for the small holder farmers that are affordable and accessible,” Dr Jones explained.

Acre Africa designs micro-insurance products based on scientific principles and data that address climate associated risks faced by small holder farmers. Since 2009, Acre Africa has been designing innovative insurance products for farmers who grow maize, beans, wheat, coffee, tea, sunflower, potatoes.

Initially, it was part of the Kilimo Salama project initiated by the Global Index Insurance Facility and the Syngenta Foundation for Sustainable Agriculture to design relevant insurance products for small holder farmers that are accessible and affordable.

Leave a comment