KCB Group Plc on Wednesday disbursed a Ksh2.12 billion in dividend earnings to the government for the year ending December 2019, signifying a sustained return to shareholders amid a tough operating environment.

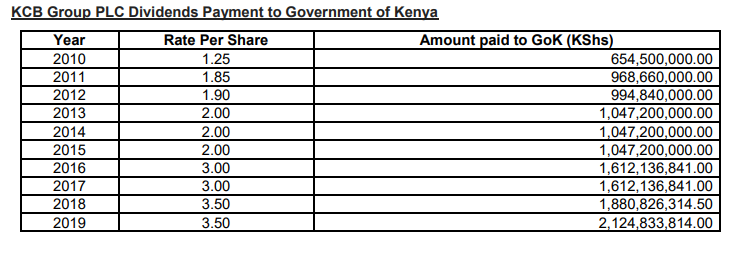

This return made up of Ksh1 interim dividend and Ksh2.50 final dividend— is the highest amount the KCB has ever paid in dividends to the government. In 2018, the payout was KShs. 1.8 billion.

On June 4, during the 2019 Annual General Meeting KCB Group shareholder approved a KShs.11.1 billion total dividend payout. The dividend is to be paid on or before July 3, 2020 to shareholders on the register as of close of business on April 27, 2020.

Speaking when handing over the cheque to Treasury Cabinet Secretary Ukur Yatani, KCB Group Chairman Andrew Wambari Kairu said KCB has over the years consistently maximized shareholder value and provided an unmatched return on investment to its shareholders and above all built a sustainable organization that is

now the biggest indigenous banking institutions in East Africa by assets, profitability.

In the last decade, the bank has cumulatively paid Ksh 12.98 billion in dividends to the government, a top shareholder.

“This payout is timely, coming at a time when there are rising expenditure demands in the wake of the COVID-19 pandemic and revenue collections are subdued. We need to channel resources directly to Micro, Small and Medium Enterprises (MSMEs) to get them going through the crisis” said Treasury CS Ukur Yatani.

The government was instrumental in the acquisition of the National Bank Kenya by KCB Group in September 2019.

Looking ahead, KCB is focused on continually supporting its stakeholders through the ongoing global COVID-19 pandemic and driving economic recovery efforts amid the global outbreak of coronavirus that has continued to put a strain on the global economy.

“As a significant player in the banking industry, we believe that our responsibilities go beyond banking, and we are committed to contributing to addressing socio-economic challenges across the different markets in which we operate. During this season when the COVID-19 pandemic has affected our economy, we are playing our role to stem the spread of the virus as well as cushion the economy through various initiatives among them restructuring of loans for our customers,” said Wambari.

The 2019 dividends are on the back of the announcement of the company’s Q1, 2020 profit after tax which increased by 5% to Kshs25.2 billion.

Last month, KCB reported KShs.6.3 billion in profit after tax in the first quarter of 2020 ending March. This was an 8% jump from the Ksh5.8 billion posted a similar period last year.

Leave a comment