Jumia appears to be generating more flak than value from its listing on the NYSE through a successful IPO, which earned it the name the “Amazon of Africa” in Western media. Just a month after listing, and days after an investment research firm blew the whistle on ‘fraud’ at the e-commerce company, a class action lawsuit has been filed on behalf of purchasers of the Jumia American Depository Shares (ADSs) who acquired the stock between April 12, 2019 and May 9, 2019.

Through Robbins Geller Rudman & Dowd LLP, the investors on May 14th filed the lawsuit in United States District Court Southern District of New York. The lawsuit is based on the damning Citron Research which alleged that Jumia had failed to state in its Form F-1 filing that 41% of its orders were not honoured – they were returned, not delivered or cancelled.

The lawsuit says that the statements made by the company were ‘materially false and misleading’ when they were made since they ‘failed to disclose the following adverse facts:

- That Jumia had materially overstated its active customers and active merchants;

- That Jumia representations about its orders, order cancellations, undelivered orders and returned orders lacked a sufficient factual basis and materially overstated the Company’s sales;

- That Jumia failed to sufficiently disclose related party transactions; and

- That Jumia’s financial statements were presented in violation of applicable accounting standards.

“In 18 years of publishing, Citron has never seen such an obvious fraud as Jumia,” Citron analysts said in heir report. “As the media in the US is naively anointing Jumia as the ‘Amazon of Africa’, the media in its home country of Nigeria has plethora of articles discussing the widespread fraud in this Nigerian company. Not even that elusive Nigerian prince can cover this one up.”

[ READ: Mobile loans apps become predators on desperate Kenyans ]

Jumia has stood by its prospectus. Sacha Poignonnec, Jumia CEO, was quoted by The Wall Street Journal saying the company is “transparent” and declined to respond directly to the claims made in the Citron report. “We don’t necessarily want to feed those types of organizations or people,” he said.

According to Jumia’s Registration Statement, the company’s operations are conducted in six regions in Africa, which consist of 14 countries that, together, accounted for 72% of Africa’s 2018 Gross Domestic Product. The Registration Statement states Jumia intends to benefit from the expected growth of e-commerce in Africa through the investments and local expertise the company developed since its founding in 2012.

The company touted strong year-on-year growth in gross merchandise volume (GMV) growth (58%) to €240 million ($270 million). GMV is non-standard accounting metric Jumia uses to show “the total value of orders including shipping fees, value added tax, and before deductions of any discounts or vouchers, irrespective of cancellations or returns.”

[ SEE ALSO: Huge losses beckon for Kenyans who invested billions in cryptocurrencies ]

It said its active users grew to 4.3 million at the end of the quarter from 3 million a year ago while total revenue grew by 12.3% to €31.8 million ($35.7 million). Gross margins on GMV rose slightly to 6.5% from 5.6% a year earlier.

“The Registration Statement issued in connection with the IPO was materially false and misleading and failed to disclose material facts necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading,” the attorneys state in the lawsuit. “These materially false and misleading statements and omissions remained alive and uncorrected during the Class Period.”

The suits argues that the material misstatements and omissions created in the market “an unrealistically positive assessment of Jumia.

Citron Report further notes that just prior to the IPO, Jumia issued a confidential investor presentation in October 2018 during a capital raising effort. According to the Citron Report, “many material discrepancies in reported key financial metrics” exist between the Registration Statement and the confidential investor presentation.

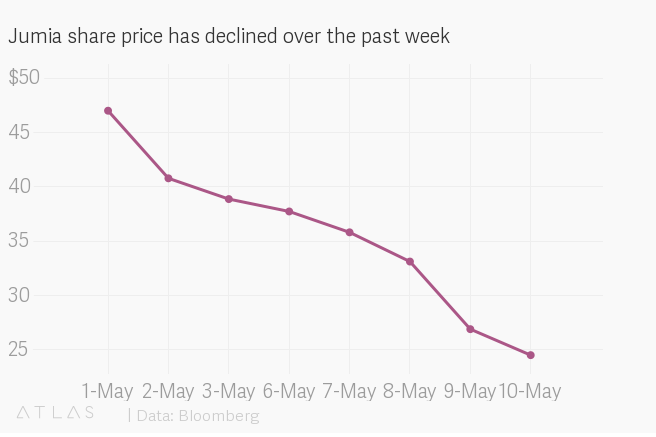

The Class Period begins on April 12, 2019, the first day Jumia shares traded on the NYSE. Before that, on April 10, 2019, Jumia issued the Registration Statement that contained information about the company’s orders, order cancellations, undelivered orders, returned orders, active consumers, active merchants and related party transactions.

Unrealistically positive engine

The The lawsuit says the management materially misled the investing public, thereby inflating the price of Jumia shares, by publicly issuing false and misleading statements and omitting to disclose material facts.

“At all relevant times, the material misrepresentations and omissions particularized in this Complaint directly or proximately caused, or were a substantial contributing cause of, the damages sustained by Plaintiff and other members of the Class,” it says.

The suits argues that the material misstatements and omissions created in the market “an unrealistically positive assessment of Jumia, its business, financial reporting, services, and financial prospects” thus causing the company’s shares to be overvalued and artificially inflated.

[ NEXT: Insider trader who made hundreds of millions fined Ksh208 million ]

Jumia are thieves I made a payment for a product and they cancelled my order and didn’t refund me