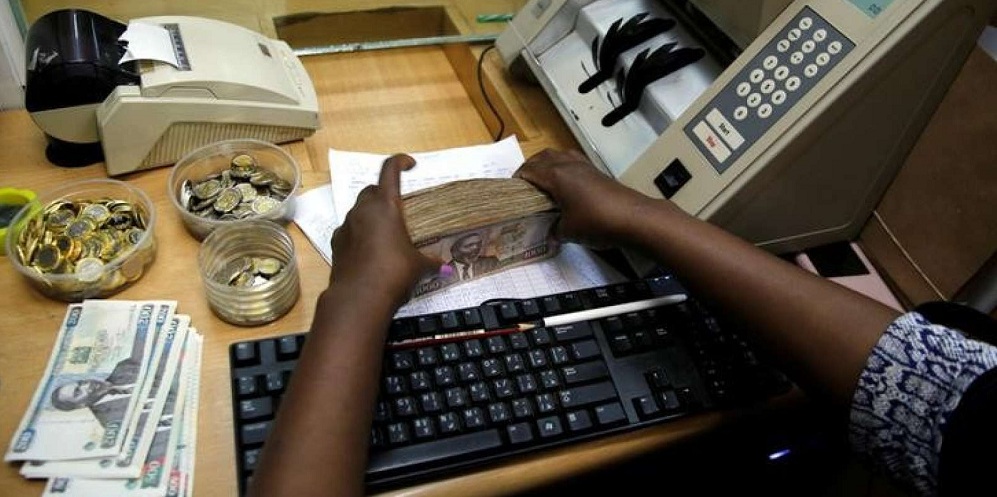

The future of tellers in commercial banks in Kenya looks dimmer as the financial institutions embrace technology and agency banking. The banks are replacing the tellers, whose work is to handle customer transactions, with agents and mobile apps, with new data indicating that it may be just a matter of time before the employees’ work becomes extinct.

The tellers, according to new data from the Central Bank of Kenya (CBK), were the most affected by job cuts in 2016, with banks laying them off as compared to any other category of employees. In 2016, the apex bank’s supervision report for the year indicated that the sector’s staff levels decreased by 7% from 36,212 in December 2015 to 33,695.

While the number of management and support staff increased, that of clerical and secretarial workers (where the tellers lie) declined by 12% while supervisors by 9%, leading to the overall decrease in the staff levels.

“This is an indicator of the banks’ improved efficiency as a result of automated processes hence reducing the number of required supervisory and clerical and secretarial staff,” said the CBK.

Some 41 million citizens in the country currently have bank accounts, up from 35 million in 2016. In 2015, one employee served 972 customers whereas in 2016, each employee was serving 1,209 customers.

The rise in the number of customers should mean more job opportunities for citizens as tellers but, according to the Central Bank, banks have moved to technology and agency banking to enhance efficiency in customer service.

See also: Why bank ATMs will soon be no more

“Commercial banks and micro-finance banks in 2016 continued to leverage on robust information and communication technology platforms to provide robust banking services,” said the regulator.

As the number of tellers drop amid rise in demand for banking services as seen in surge in number of customers, a look at 2016 agency banking figures shows why the future of many bank employees seem is bleaker.

As at December 2016, 18 commercial banks and five microfinance banks (MFB) had contracted 53,833 and 2,068 agents respectively spread across the country. In December 2015, the number of agents contracted by commercial banks and MFBs were 40,592 and 1,154 respectively.

“The change implies a 33% increase by 13,241 agents and 79% increase by 914 agents growth of number of agents contracted by commercial banks and microfinance banks respectively,” said the bank.

READ: New banks’ money transfer service hits a milestone

The big banks, which are sacking more staff, have over 87% of the approved commercial bank agents. They include Equity Bank Ltd. with 25,428 agents, Kenya Commercial Bank 12,883 and Cooperative Bank 8,856.

“The overall increase in the number of agents is attributed to the growing confidence and acceptability of the agency banking model by the public and banks as an alternative channel of doing banking business,” said the apex bank.

The value and number of transactions carried out on the agency banking platform paint to this fact.

The number of transactions undertaken through bank agents increased in 2016 by 31 percent from 90 million in 2015 to 106 million. And so was the value, which nearly doubled compounding the problem further for bank tellers.

“The value of banking transactions undertaken through agents increased from 4.3 billion dollars to 7.1 billion dollars, with the increase attributed to the growth of transactions relating to payment of retirement and social benefits, transfer of funds, cash deposits and cash withdrawals,” said CBK.

A good number of bank employees are aware of the trends in the banking sector and some are even changing careers.

“I joined the bank as a teller five years ago but realised I may not last long in that job as soon as they launched agency banking. I decided to further my knowledge in capital markets and right now I work in the bank’s securities department,” said Maryanne Wanyama, a banker, on Monday.

Related: Faster Equity Bank, PayPal service

Her bank is among those that are aggressively doing away with tellers, having placed agents inside all their branches.

“Technology is taking away jobs not only in the banking sector but also others. For banks, however, the urgency to adopt to new processes had been necessitated by the introduction of interest caps which ate into profits,” said Henry Wandera, an economics lecturer in Nairobi.

He, however, noted that as banks shed off teller jobs, they are creating more jobs in the informal sector through agency banking. “In fact it is a win-win situation if you look at the number of agents vis-à-vis the number of bank employees. It is like banks are taking from the left hand and giving it to the right,” he said.

Leave a comment