[dropcap]S[/dropcap]afaricom CEO Bob Collymore was not surprised that the first big issue he had to tackle on returning from a nine-month medical leave was the pet topic of his telecommunications rivals.

Dominance remains a sticky issue among smaller operators Airtel and Telkom, who have been cajoling authorities to declare Safaricom, the market leader in voice and money transfer, a dominant player.

“That view is short term,” Collymore told MPs sitting on the Departmental Committee on Communication, Information and Innovation inquiring into legislative and regulatory gaps affecting competition in the telecommunications sector in Kenya.

“It will not develop Kenya. It will not grow our economy and provide jobs or new technologies to our people. It is a race to the bottom, where the successful operator is targeted with interventions that will seek to damage it to give advantage to other operators.”

His responses debunked a number of myths pedaled by Safaricom rivals to brand it a dominant player.

Telkom CEO Aldo Mareuse argues that “no single operator should dictate how the market operates and consumers should not be ring-fenced by a single operator,” while others say Safaricom should be flagged since it controls over 70% of the market in both voice and mobile money.

Bob Collymore did break any sweat to defend Safaricom. He let history speak for itself on how Safaricom, started as a small department within the then Telkom Kenya, has grown to the company that today serves close to 30 million Kenyans with a diverse set of services, fueled by a ruthless innovation machine and homegrown growth and marketing strategies. The company is now the most profitable company in the region.

“Because of this growth,” Collymore told MPs, “…. we are now considered a dominant operator that should be singled out for punishment for simply being successful.”

The backers of the ‘dominance” school of thought hang on the Analysys Mason Report on Telecommunication Competition Market Study, which the Communications Authority seeks to use declare Safaricom dominant in certain market segments.

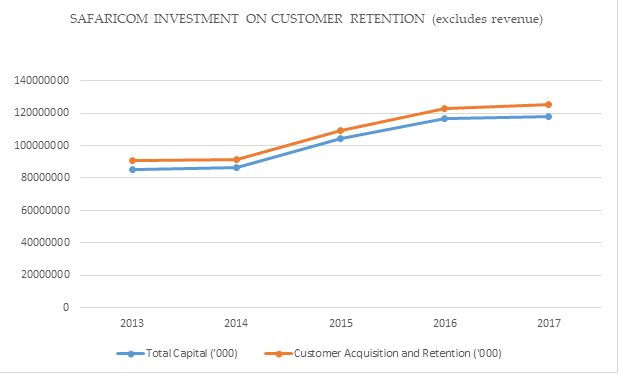

Market experts, though, say a number of remedies or interventions proposed in the report – including prohibition of loyalty schemes and on-net call discounts – would punish Safaricom’s customers, stifle innovation, discourage investment and reward competitors who do not invest in their networks as they should.

In essence, this would introduce retails price controls on Safaricom services, which would lead to an increase in the applicable rates and thus repulse consumers. This creates an artificial competitive landscape that rewards Safaricom’s competitors and disadvantages Safaricom’s customers.

The mobile communications sector has witnessed entry and exit of players as well as introduction and differentiation of services. The first Mobile Network Operator (MNO) Kencell entered the Kenyan market in 2000, rebranded to Celtel Kenya in 2004 then to Zain in 2008 and later to Airtel in 2010.

RELATED: SAFARICOM FORAY IN FOREIGN MARKETS FACES STIFF COMPETITION

Telkom operations in 2007, it later rebranded to Orange Telkom in 2008 and rebranded again to Telkom in 2016. In 2008, Essar Telecom Kenya began operations in Kenya after rebranding from Econet Wireless but later exited the market in 2014.

Safaricom, on the other hand, began its operations in 2000 and has operated under the same brand name since, which shows how stable its strategy has been.

The initial battle between for customers gave Safaricom an edge over Kencell. Kencell began with per minute billing on voice communication and targeted corporate clients. When Safaricom entered the market, it introduced per second billing on voice communication, with a single minute call then costing up to Ksh25.

Mr Mareuse, the Telkom CEO, says the move from per-minute billing to per-second billing, for instance, was a result of operators trying to outdo each other. “To have the current set of players in the market accomplish such a state of competition today would not be possible,” he argues.

Their growth will be fueled by an artificial competitive landscape that overprices the services of one operator over others.

But market watchers say Kencell was forced to dump per minute billing for per second billing that was attracting more customers to Safaricom network. “In 2002, when Safaricom introduced per-second billing, the cheapest airtime cards available from Kencell cost Ksh300,” according to Wilbur Ahoya, a telecommunications expert.

READ: ENGINEER WINS HOUSE IN M-PESA PROMOTION

“Many of us remember what caused the migration from Kencell to what was then packaged as The Better Option. This was simply because the airtime available was rather expensive and speaking for 10 seconds cost as much as speaking for 60 seconds. These were not just operators trying to outdo each other. This was an operator catering to the needs of their customers.”

The other recommendation is imposition of regulations for mandatory sharing of infrastructure, which would protect other players from heavy investments and thus leave them with big budgets for marketing and promotions. The regulator should ensure sustainability of the industry by subjecting every licensee with a minimum threshold investment requirement in the towers market. Incidentally, Telkom has already sold its towers while Airtel has been divesting from it.

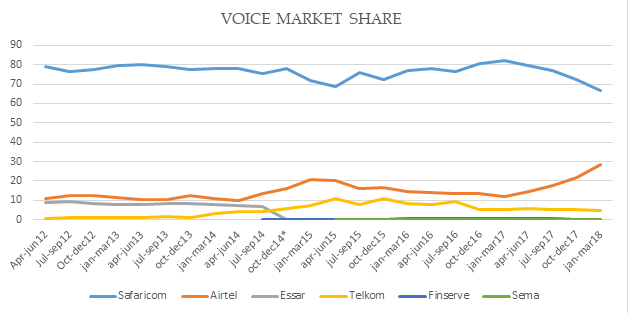

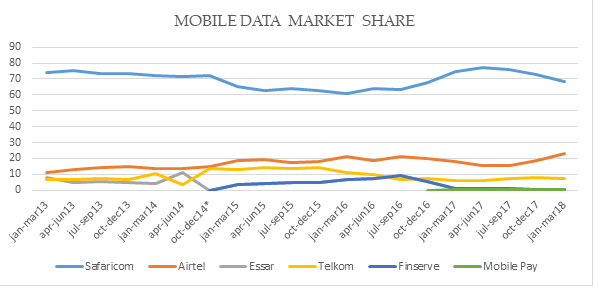

The market has six players namely, Safaricom PLC, Airtel Networks Limited, Telkom Kenya, FinServe Africa Limited, Sema Mobile Services and Mobile pay limited. Safaricom voice market share reduced from 73% to 68% during the period October- December 2017 and January- March 2018 whereas Airtel gained 5 percentage points (from 18.5%- 23.1%) during the same period.

READ: FOUR EASY WAYS YOUNG KENYANS CAN RAISE BUSINESS CAPITAL

The mobile money segment has five players namely, M-Pesa, Airtel Money, T-Kash, Equitel Money and Mobile Pay. According to data from Communications Authority, the players have the following market shares; Safaricom PLC 83.08%, Equitel 16.36% and Airtel 0.56%.

In terms of subscriptions from Q4 2016/17 to Q3 2017/18, the data indicates a lot of dynamism in terms of markets shares, with Safaricom share declining from 72.6 % to 66.7%.

Independent analysis and research by Competition Authority of Kenya gives a strong case for cautious steps towards regulating the sector targeting a successful player. “…there has been a lot of dynamism in the market shares among all the relevant retail markets,” it says in its submission to the parliamentary committee.

Seeking interventions

“Specifically, the dominant firm Safaricom has been progressively losing its market share over the period analyzed. This means Safaricom does not possess Significant Market Power (SMP) over any of the markets analyzed.”

Indeed, infrastructure sharing is already happening on a commercial basis in an arrangement where operators are able to use each other’s towers, fibre, fibre ducts, among other infrastructure. There are also independent tower that can then be used by any operator. Imposing a prescribed tower sharing rate will disadvantage companies such as Safaricom (and the independent tower companies) that have invested in towers.

The operators seeking these interventions will be relying upon the infrastructure built by others. They won’t need, for instance, to invest in innovations as it will be served to them on a silver platter. Their growth will be fueled by an artificial competitive landscape that overprices the services of one operator over others. Instead, they should raise their game and invest in innovation and marketing to compete fairly against Safaricom.

2 Comments