Safaricom Chief Executive Officer (CEO) Peter Ndegwa has announced that the telecommunications firm is planning to remove four million customers who have been blacklisted and listed on the Credit Reference Bureau (CRB) in a move likely to hit the mobile operator as most borrowers are likely to get away with loans.

Read >> Is e-Commerce Startup Exiting Harsh Kenyan Market?

According to Mr Ndegwa, the customers will be removed from CRB blacklist by November. The company will work with KCB Bank and NCBA, its partners in mobile loans, to implement the presidential directive. Mr Ndegwa noted that the delisting of the customers from CRB will enlarge the customer base, which will then lead to increase in revenue collection.

The reprieve for blacklisted borrowers came after an order by President William Ruto to regularise borrowers on Credit Reference Bureaus (CRBs) and other blacklists from November this year after meeting officials from Treasury, Central Bank, Safaricom, Kenya Commercial Bank (KCB) and NCBA on 28th September.

Dr Ruto said the lenders agreed to develop a new credit score system as opposed to blacklisting customers. The President explained that the Government will underwrite the risks that will come with the new move.

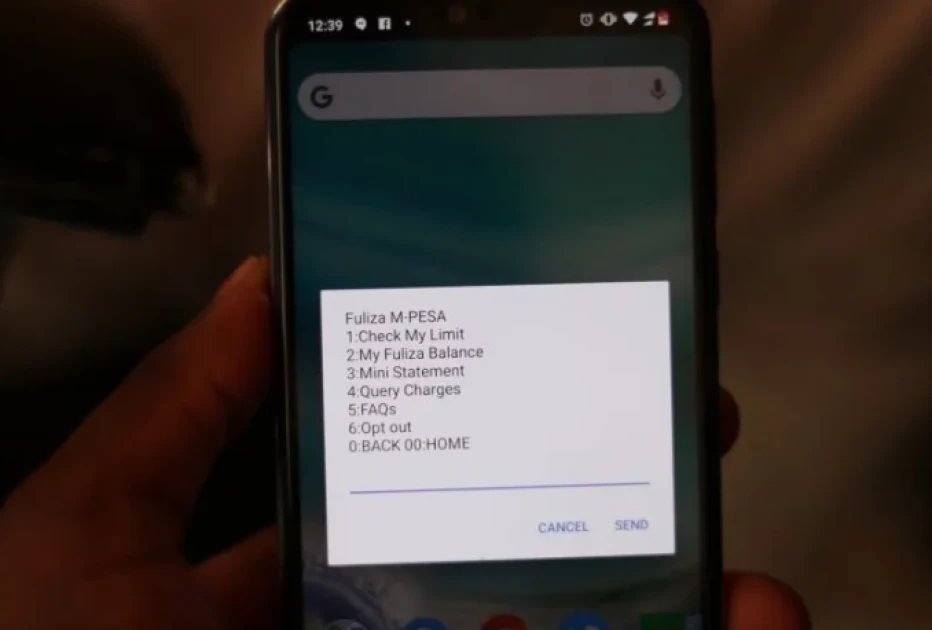

“Today we have reduced Fuliza costs by 50 percent on average,” Mr Ndegwa , the Safaricom CEO, said. “We are also working with NCBA and KCB as our banking partners, and they are going to be repairing four million customers that were previously listed on the CRB.”

The telecommunications CEO further noted that all customers delisted from CRB will not be blocked from re-borrowing loans from any money lending services. “We will be taking them off the listing in the CRB so that they are able to access new loans; it will be 4 million additional new customers who will be free to access Fuliza and other lending products out there…the repair will happen from November.”

Mr Ndegwa said that the move will then increase the number of customers who will use Fuliza or any other money lending services, which will then cater for recovery of the losses that might have occurred from the delisting.

“Yes, Safaricom and banks will lose a lot of money, and a reduction in the revenue that we earn,” he said. “Since we reduced the cost, we have seen an increase in numbers using Fuliza, more frequency of customers using Fuliza and higher amounts using Fuliza.”

Mr Ndegwa said over time the revenue will be recovered through the additional usage by customers. “We believe that if the product is more sustainable and affordable, it will be better for the future of this product and its customers,” he said.

[ BY FRANKLINE MACHARIA ]

Next >> Inside Fred Obach Machoka’s Multi-Million Ranch, Resort And School

![Following a successful rollout to India's 65 million MSMEs through an e-commerce platform since last year, Solv is making its debut in Africa. [Photo/ Money254]](https://businesstoday.co.ke/wp-content/uploads/2022/10/60f9c24abbd1f8832e11505a_Kenyas-new-Currency-150x150.jpg)

Leave a comment