A new report from Uber Eats Kenya underscores the growing scale and economic implications of the country’s meal and grocery delivery market, highlighting shifts in consumer habits and significant revenue generated for local businesses and couriers.

The inaugural Kenya Cravings Report 2025 uses aggregated user data to provide a snapshot of a market increasingly prioritizing convenience, with high-value orders and significant time savings emerging as key metrics.

Economic Scale and Market Penetration

The findings suggest that delivery platforms are moving beyond a discretionary service to become an integral part of daily commerce and logistics in major Kenyan cities. The report notes that Uber Eats users collectively save over 448,000 hours per year by outsourcing meal and essential deliveries, a statistic the company uses to frame its value proposition in a busy, urbanizing economy.

The platform generated an estimated KSh 534 million in additional revenue for Kenyan restaurants in 2023, according to figures cited in the report.

Delivery partners and drivers earned KSh 2.2 billion more than their next-best alternative income, with the value of flexibility in scheduling estimated at an additional KSh 1.6 billion benefit to their livelihoods.

Kui Mbugua, General Manager for Uber Eats Kenya, commented, “These insights show just how deeply Uber Eats is woven into everyday life in Kenya. Every order supports a courier, strengthens a local business, and brings more convenience and choice to customers.”

High-Value Transactions Signal Market Maturation

The report captured several high-value transactions, indicative of a market comfortable with premium and bulk ordering.

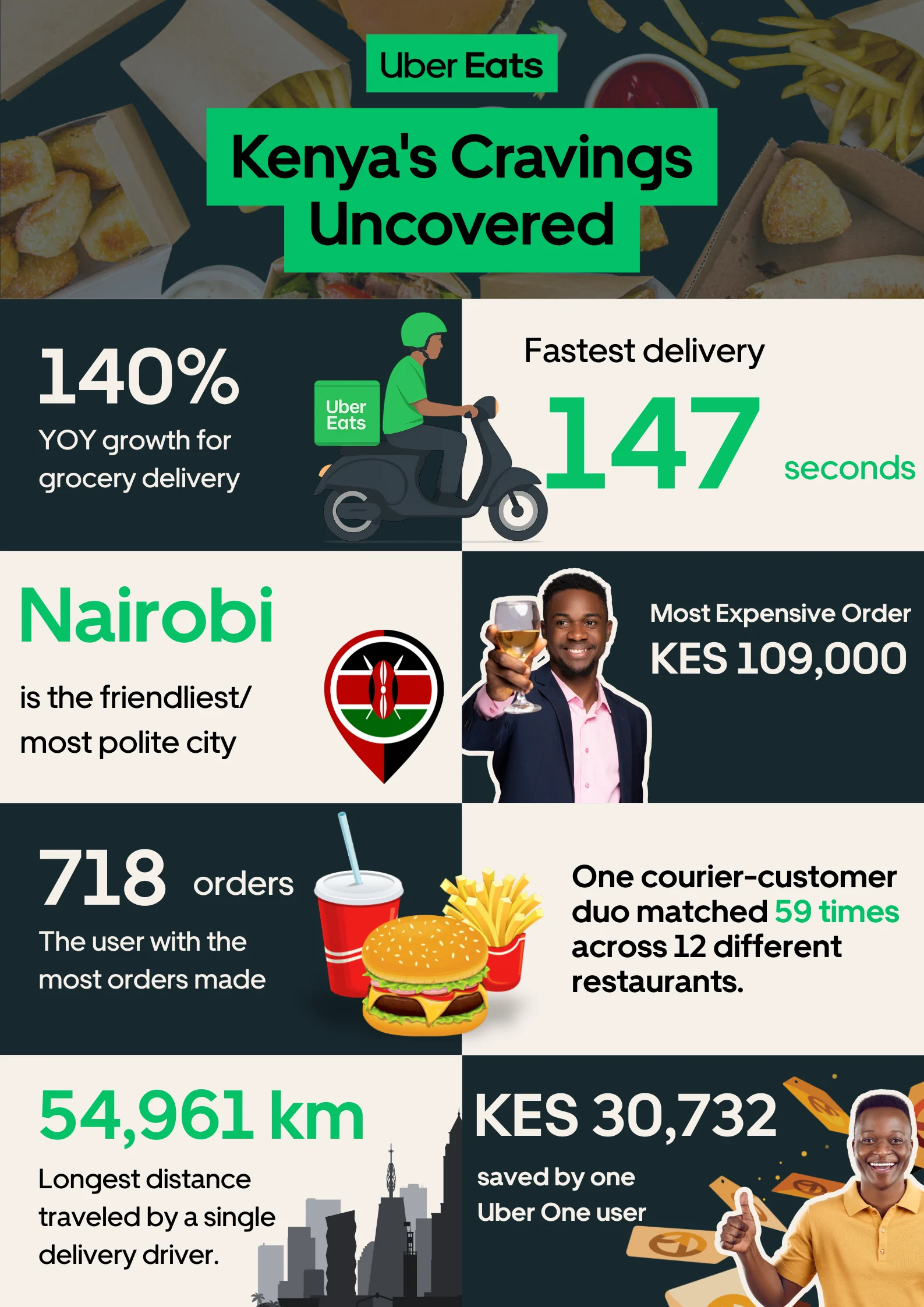

The largest recorded single order was for premium beverages, totaling KES 109,000. Another significant order included a fast-food feast costing KES 102,134, comprising nearly 20 burgers and sides.

The top-spending individual user spent over KES 1.8 million on the platform in 2025, demonstrating a dedication to high-frequency or high-value consumption.

Analysts often view such “power users” as a sign of market maturation, where the delivery platform becomes a primary utility rather than an occasional luxury.

Cravings: A Snapshot of Consumption

While anecdotal, the report’s top food trends offer insight into mass-market preferences:

-

Fried Chicken retained its spot as the most-searched item on the platform.

-

Pizza followed as the second-most-searched food, confirming its mass appeal for group and convenience eating.

-

Grocery Delivery has shown significant acceleration, transitioning from emergency items (like a recorded 150-second delivery of a 5-litre bottle of cooking oil) to a reliable household supplement.

The efficiency of the logistics network was also highlighted, with the fastest recorded delivery clocking in at 147 seconds.

The Uber Eats report positions the delivery platform as a significant, quantifiable driver of the local service economy, leveraging data on consumer behavior to showcase its growing footprint in Kenya’s retail and food sectors.

Leave a comment