Prudential Life Assurance has announced key leadership appointments in a bid to drive growth in East and Central Africa.

The region which covers Uganda, Kenya and Zambia, is led by Mr Arjun Mallik who was formerly the CEO of Prudential Uganda.

Under his leadership, Prudential Uganda has been recognised as the fastest-growing life and health insurer for the last five years. Most recently, it was named the ‘Most Innovative Life Insurer’ in Uganda by the Insurance Regulatory Authority of Uganda.

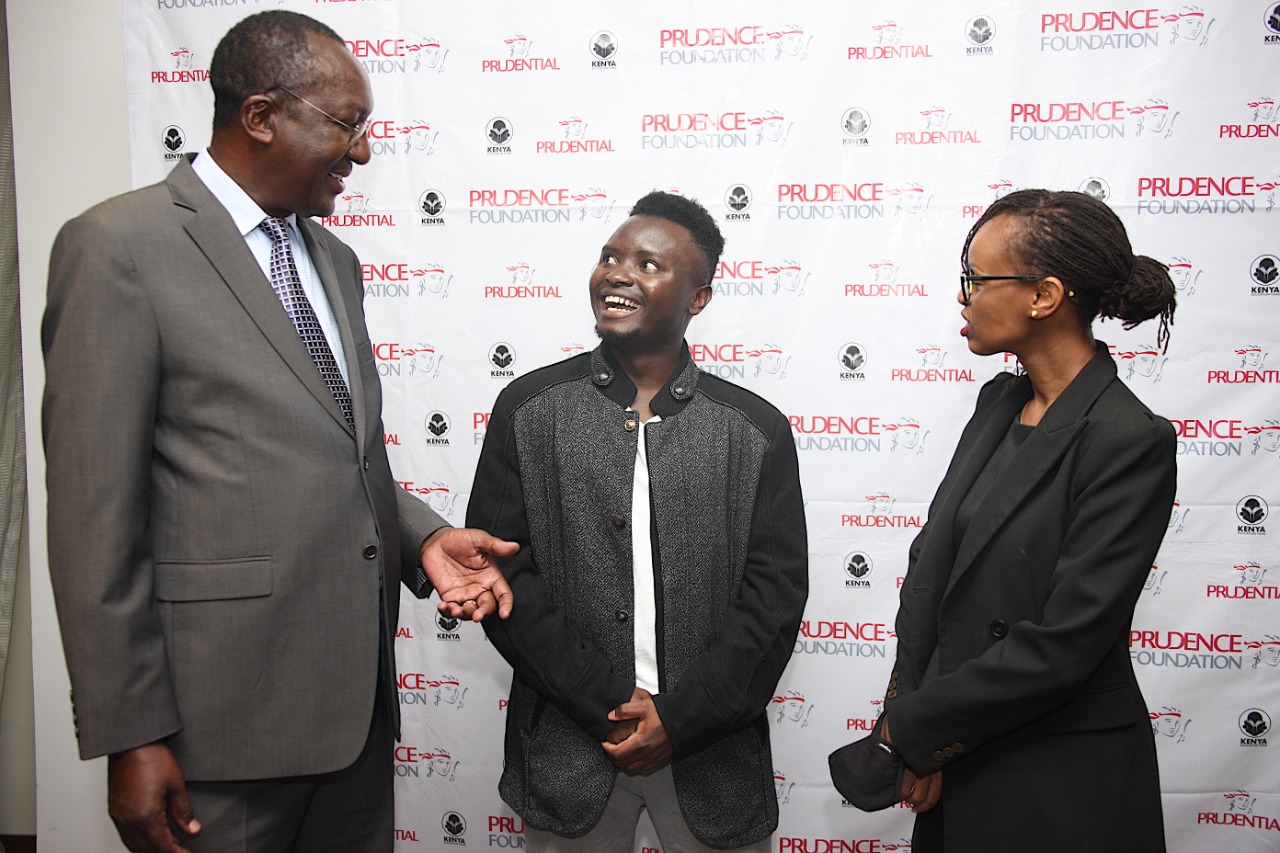

Gwen Kinisu has been appointed CEO of Prudential Life Assurance Kenya (PLAK), an anchor market for Eastern and Central Africa and will report to Arjun. She takes over from Raxit Soni who presided over a period of growth for PLAK and a series of impactful community activities. He assumes the role of Chief Actuary, Prudential Africa.

Raxit joined PLAK seven years ago as the Head of Risk and Compliance. Gwen has over 14 years of experience in insurance and banking. She was the Chief Commercial Officer for PLAK since 2018 and during her tenure drove continued growth in the business and built strong relationships with banks, brokers and other partners.

Wilf Blackburn, Regional CEO, Insurance Growth Markets, Prudential Corporation Asia said that the new appointments are part of the insurer’s commitment to developing talents to accelerate growth for its African business.

“Prudential has laid a solid foundation in Africa over the past seven years and will continue to scale its operations and strengthen local capabilities to deliver on its growth strategy. Core to our commitment is the investment we are making in the development and advancement of our people. Our Africa leadership team demonstrates the opportunities we are creating and will continue to create for our talents in the continent,” said Blackburn.

East and Central Africa is one of four sub-regions in the continent that Prudential has a presence and interest in. The other regions are Francophone Africa, Western and Southern Africa and Northern Africa.

Prudential established its first office in the region seven years ago. Today, it serves over 1.3 million customers and has a distribution network of more than 13,000 agents and over 600 bank branches across eight countries, namely Ghana, Kenya, Uganda, Zambia, Nigeria, Cote d’ Ivoire, Cameroon and Togo.

Read: Kenindia Assurance appoints new CFO

>>> Blow for Prudential Life Assurance as CEO quits

Leave a comment