Nairobi is fast emerging as a leading African hub for financial services, digital innovation, green finance, and regulated virtual assets, following a series of high-level engagements at the World Economic Forum in Davos.

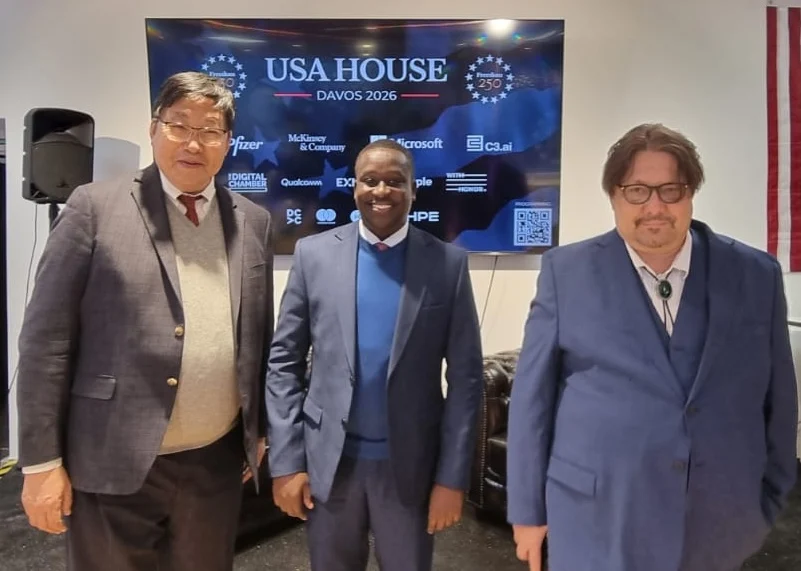

The Nairobi International Financial Centre Authority (NIFC) met with global investors and technology leaders at a private leadership breakfast hosted by SCC Fund SP, ChainBLX SPC, and Digital.Davos. The discussions focused on deploying compliant blockchain infrastructure, building institutional-grade digital platforms, and scaling innovation in line with international regulations.

The meetings were a major boost for Kenya’s investment agenda, with both ChainBLX SPC and SCC Fund SP announcing plans to establish operations in Kenya. These initiatives will be supported by NIFC, strengthening Nairobi’s position as a regional financial hub.

Speaking in Davos, NIFC Chief Executive Officer Daniel Mainda said Kenya is moving from momentum to building strong foundations. He explained that the Nairobi International Financial Centre is creating real markets, backed by clear regulations, strong institutions, and tangible economic results.

Mainda added that Nairobi is positioning itself as a trusted platform for capital, innovation, and regulated digital assets. He said the city offers active support, regulatory guidance, and incentives for regional headquarters, venture capital and private equity funds, and high-growth startups.

“We will compete on regulatory quality, not regulatory arbitrage and we are open for serious business,” he said.

The discussions also highlighted Kenya’s progress in establishing a clear framework for digital and virtual asset service providers following the Virtual Asset Service Providers Act. This framework makes Nairobi an attractive base for international digital asset companies serving African markets from a stable and well-regulated jurisdiction.

Strong innovation ecosystem.

Karl Seelig, Founder and Managing Partner of ChainBLX SPC, welcomed the engagement, saying that Kenya combines regulatory certainty with a strong innovation ecosystem. He noted that the collaboration with NIFC reflects a shared commitment to building compliant, scalable digital infrastructure with real commercial value.

SCC Fund SP CEO Dr. Yutaka Niihara said Kenya is showing how forward-looking regulations and digital infrastructure can support trusted innovation at scale. He added that discussions in Davos show growing confidence in Nairobi as a regional platform for investment.

NIFC also highlighted Kenya’s work on national capital platforms, including the National Infrastructure Fund and sovereign investment frameworks, aimed at attracting long-term private capital and improving project delivery.

The Nairobi International Financial Centre Authority emphasised that Nairobi welcomes international firms across financial services, fintech, digital assets, carbon markets, and green finance. Investors can expect regulatory clarity, skilled talent, and strategic access to African markets.

With global capital increasingly favouring jurisdictions that combine innovation and trust, Kenya is positioning itself as a reliable and competitive partner for long-term investment.

Leave a comment