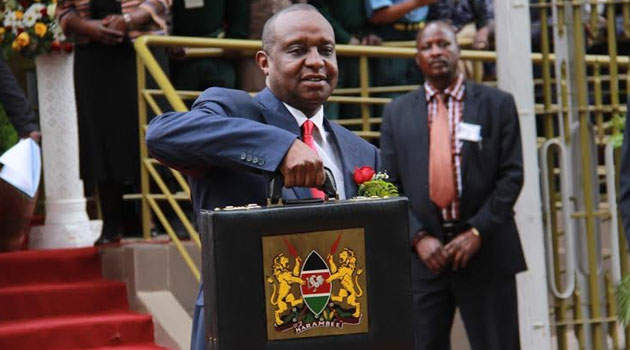

Treasury Cabinet Secretary Henry Rotich is set to present the Ksh3.02 trillion budget for the financial year 2019/2020 at the National Assembly at a time when the Kenya Revenue Authority (KRA) has failed to reach it’s revenue targets leaving the treasury honcho sweating on exactly how he will plug the estimated Ksh607 billion budget deficit that will accrue.

Rotich has set KRA a target of Ksh2.2 trillion against the Ksh 1.8 trillion that the taxman has raised which is likely to pile more pressure on incoming KRA Comissioner General James Githii Mburu.

Eyes will be trained on Rotich as he reads the country’s largest budget since independence.

Allocations

From the Ksh3.02 trillion the government will allocate Ksh1.7 trillion to fund it’s operations, Ksh371.6 billion has been earmarked as the equitable share for the counties and Ksh805.8 billion will be channeled towards the Consolidated Fund Services (CFS), a facility to which all revenue due to the national government is channeled.

This year, most of the money in the consolidated fund will go towards servicing the country’s mammoth debt.

In the budget, Ksh473.3 billion will be taken by the education sector. Energy, ICT and Infrastructure are expected to gobble up Ksh406.7 billion.

National Security will consume Ksh139.1 billion, Defence Ksh121 billion, Health Ksh93 billion and Agriculture Ksh59.1 billion.

Backdrop

Latest Central Bank of Kenya (CBK) shows that the public debt currently stands at Ksh5.4 trillion but analysts opine that the government might be forced to borrow in order to ensure that it funds the various development projects it has lined up.

Osborn Wanyoike, an associate director at audit firm PricewaterhouseCoopers(PwC) says that Rotich has a difficult task on his hands in ensuring that the budget for the next financial year aligns to the country’s goals.

{Read; Knight Frank: Idle money likely to be injected into the economy}

According to Wanyoike, Rotich only has two options to ensure that KRA meets its targets by ensuring that it nets tax cheats or raise taxes but says it is unlikely the treasury mandarin is unlikely to go down the latter route.

“Given the country’s economic state at the moment. Treasury will choose to go about this administratively meaning that KRA will have to dig in,” said Wanyoike “The Cabinet Secretary will want to avoid being to aggressive in increasing the tax rates because the headroom is not there and that is likely to impact the economy and investments,”

Audit firm PKF says that the government should look at other alternatives besides borrowing or raising to fund his budget.

{See also: Government struggling to sustain salaries over ballooning debt}

“Creating new taxes will not solve the problem for the government because businesses are already struggling, companies and SMEs are retrenching people what KRA can do is to target the informal sector and engage the businesses which are not already paying taxes,” Micheal Mburugu, a partner at PKF told Business Today in a phone interview.

He also called on the government to consider a 10% tax amnesty for corporates for a period of two years to enable them recover after which the government will raise taxes from employed individuals once the companies recover.

Leave a comment