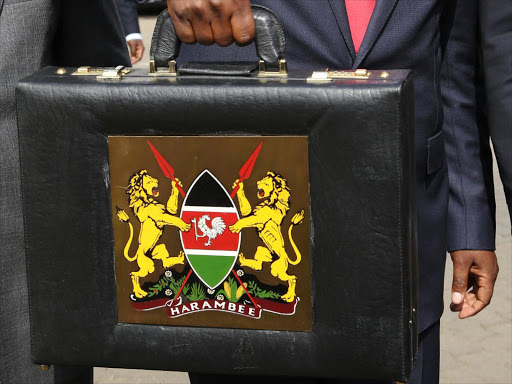

The Treasury has confirmed that the government is mulling introducing higher taxes on Kenya’s super-rich and high-income earners in the new budget starting July.

The budget is expected to prioritize economic recovery and job creation following the effects of the Covid-19 pandemic – and a wealth tax is one way to raise revenues. The Kenya Revenue Authority (KRA) has consistently recorded shortfalls since the onset of the pandemic – which saw tax relief measures put in place for several months even as firms sent home workers, slashed their wages or shut down entirely.

Treasury Principal Secretary Julius Muia noted that the proposed wealth tax was only one of a number of fiscal reforms being considered for the budget. He, however, failed to offer details on how it would be implemented.

“We are looking at fiscal changes that will go into the Finance Bill and we are in discussions over the wealth tax among many other fiscal reforms to boost revenues,” he told journalists.

A 2018 bid to impose a higher maximum tax rate of 35 per cent on income of more than Ksh9 million a year or Ksh750,000 a month flopped – with the Treasury dropping the plan after public participation on the Draft Income Tax Bill.

Muia seemed to acknowledge that the newly proposed wealth tax could run into similar headwinds, asserting that stakeholder consultations would be key in formulation of the tax and its structure.

READ ALSO>>>>>Kenya’s Super Rich: 16 Billionaires Fall Off List After Covid-19 Hits Their Fortunes

“It is too early to comment on how it will look because we are still consulting to bring people on board.

“The complexity of budget proposals undergo a lot of simulation, structured stakeholder consultations, considering a lot of aspects, looking at facts without nuance before policy is implemented,” he noted.

The move notably comes amid a global conversation on imposing higher taxes on the rich – with a growing movement piling pressure on their governments to do so as a way of taming inequality and channeling resources to neglected and impoverished communities.

In the United States, Democratic Party candidates in the 2020 Presidential election including Bernie Sanders and Elizabeth Warren all had a wealth tax among their signature policies,

University of California Berkeley economists Gabriel Zucman and Emmanuel Saez, who advised Sanders on his plan, claimed that the proposal would cut the wealth of billionaires in the United States in half in 15 years and entirely close the gap in wealth growth between billionaires and the average American family.

American citizens and residents pay a top tax rate of 37 per cent for earnings over $518,401 (Ksh56.7 million) a year. In the UK, the top individual tax rate is 45 per cent on annual income above Ksh21.8 million.

Leave a comment