Vodacom and Safaricom have announced completion of the acquisition of the M-PESA brand, product development, and support services from Vodafone through a newly-created joint venture in a transaction estimated at Ksh1.42 billion ($13.4 million).

The transaction, which was first announced in 2019, will accelerate M-PESA’s growth in Africa by giving both Vodacom and Safaricom full control of the M-PESA brand, product development and support services as well as the opportunity to expand M-PESA into new African markets.

Shameel Joosub, Vodacom Group CEO, said this is a significant milestone for Vodacom as it will accelerate financial services aspirations in Africa.

“Our joint venture will allow Vodacom and Safaricom to drive the next generation of the M-PESA platform – an intelligent, cloud-based platform for the smartphone age,” said Joosub. ”It will also help us to promote greater financial inclusion and help bridge the digital divide within the communities in which we operate.”

Mr Michael Joseph, outgoing Safaricom CEO said the acquisition would allow Safaricom to consolidate the M-PESA platform development and synchronise more closely in terms product roadmaps.

“For Safaricom, we’re excited that the management, support and development of the M-PESA platform has now been relocated to Kenya, where the journey to transform the world of mobile payments began 13 years ago,” Mr Joseph said. “This new partnership with Vodacom will allow us to consolidate our platform development, synchronise more closely our product roadmaps, and improve our operational capabilities into a single, fully converged centre of excellence.”

Vodafone Group’s CEO Nick Read said M-PESA is hugely successful and enables millions of unbanked people in Africa to transfer money, pay bills and trade, adding that it benefits communities and helps create a multitude of small and micro-business ventures.

“However, with the rapid increase in smartphone penetration,” said Mr Read, “the evolution into financial services and the potential for geographical expansion, we believe the next step in M-PESA’s African growth will be more effectively overseen by Vodacom and Safaricom.”

NEXT >> Jeff Koinange Being Auctioned Over Huge Bank Loan

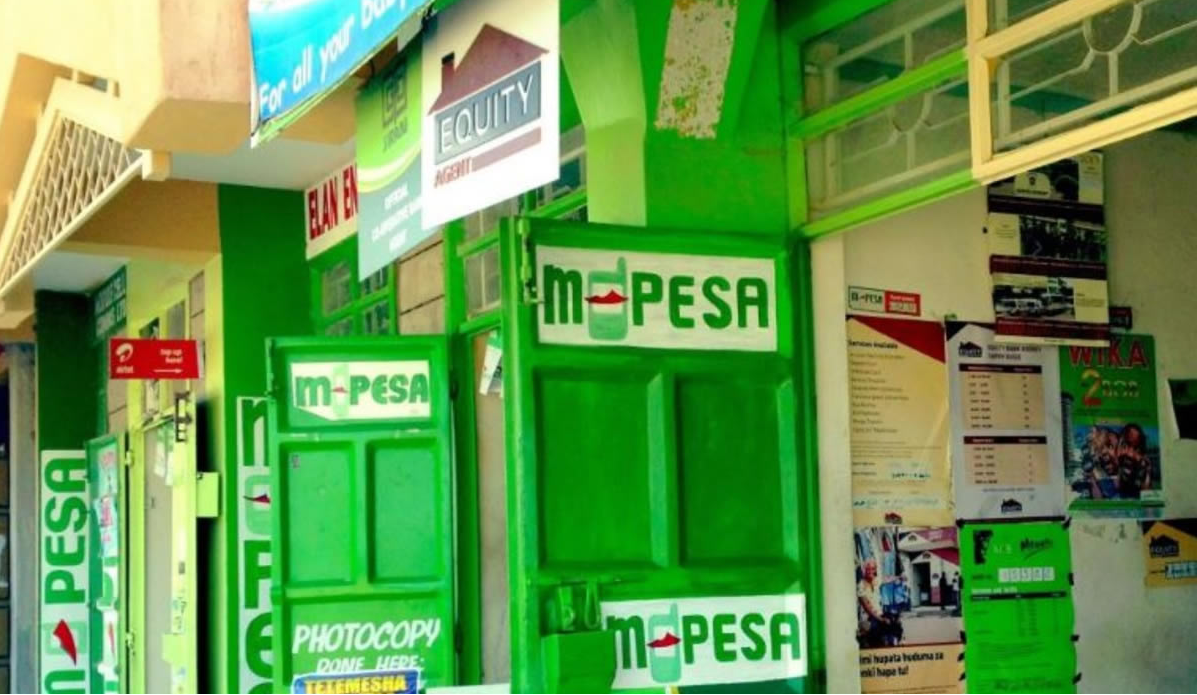

M-PESA is the largest payments platform on the African continent. It has 40 million users and processes over a billion transactions every month. M-PESA is operational in Kenya, Tanzania, Lesotho, Democratic Republic of Congo, Ghana, Mozambique and Egypt.

Currently, around 25% of M-PESA customers have access to a smartphone – a figure that is growing by 10% every year. The disposal of the M-PESA brand, support and product development services to Vodacom and Safaricom is broadly financially neutral for Vodafone Group.

Leave a comment