The Digital Lenders Association of Kenya has rebranded to Digital Financial Services Association of Kenya (DFSAK) as the association reported disbursing over Ksh500 billion in mobile loans to small businesses and households over the last eight years.

“With a robust regulatory environment and increasing consumer interest, we expect the sector to keep deepening financial inclusion in the coming years,” said DFSAK chairman Kevin Mutiso during The Digital Finance Summit 2023 in Nairobi.

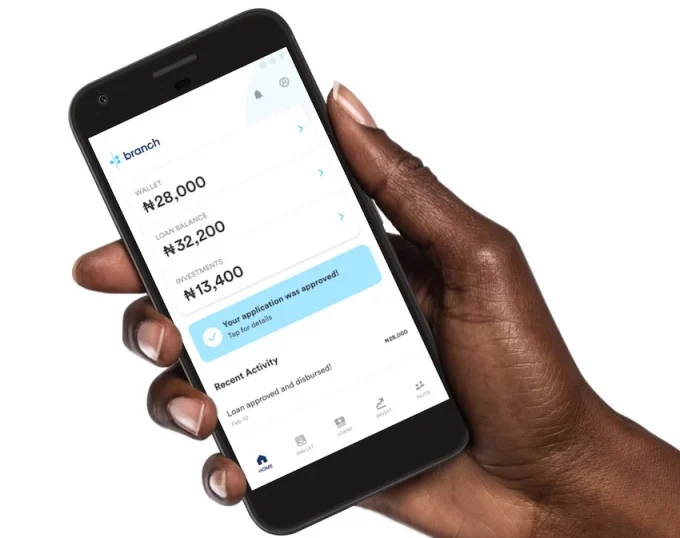

More than 8 million Kenyans equivalent to a million customers every year have benefitted from mobile micro-loans, with an estimated 70% of borrowers borrowing for business reasons.

A vibrant tech ecosystem and opening up of Africa’s digital economy are now seen creating more opportunities for Medium-Small and Micro Enterprises (MSMEs) that are increasingly hopping into digital and social media platforms to acquire customers and new markets.

“We foresee demand for mobile credit rising as small local businesses turn to online marketing platforms and seeking growth funds beyond borders,” Mutiso said

Digital services are projected to add an extra $180 billion to Africa’s GDP by 2025, according to the United Nations Conference on Trade and Development (UNCTAD).

Backing this trend is a near doubling of Kenya’s Fintech Start-Ups totalling $574.8 million (Ksh71. 7 billion) in 2022 from $292 million (Ksh36. 4 billion) in 2021.

DFSAK is now looking to ride on these positive market sentiments to rack up more funding towards onward lending to the growing customer numbers, develop new digital financial services such as digital insurance, digital savings plan and digital investment platforms while bolstering financial literacy levels and oversee licensing of more providers.

“In the next phase, the Association is looking to overturn the shortfalls experienced in the last eight years including harmful debt collection practices still prevalent even as licensing continues,” he added.

Since September 17, 2022, Licensing of Digital Credit Providers is still slow as only 22 out of over 400 lenders have been approved.

DFSAK said it will continue fostering meaningful engagement with the government as it celebrates among its key wins, spotlighting the bad actors in the sector and effectively reducing the harmful lending practices in Kenya.

Read: CBK Licenses 12 More Digital Lenders – See All 22 Licensed So Far

>>> Regional Jitume Labs Launched To Equip Youth With Digital Skills

![I&M Bank Tower in Nairobi. [Photo/ Standard]](https://businesstoday.co.ke/wp-content/uploads/2023/03/ezgif.com-webp-to-jpg-5-150x150.jpg)

Leave a comment