The Quarterly Statistical Bulletin for the period ended March 2020 by the Capital Markets Authority (CMA) shows Cytonn Money Market Fund as the fastest-growing unit trust scheme.

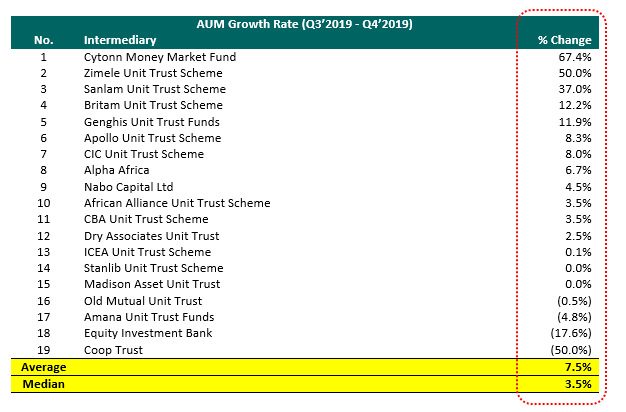

According to market analysis for the period covering the third and fourth quarters of 2019, Cytonn Money Market Fund (CMMF) topped the list of the 19 approved active collective investment schemes based on assets under management.

Cytonn Money Market Fund recorded assets under management growth of 67.4%, from Ksh430 million in Q3 of 2019 to Ksh720 million in Q4 2019, against the industry average of 7.5%.

Zimele Unit Trust Scheme had the second highest growth of 50.0% of assets under management, with Sanlam Unit Trust Scheme coming in third with a growth of 37.0%.

According to the report, CIC Unit Trust Scheme managed the highest assets under management of Ksh29.7 billion as of December 2019, which was 39.0% of the total assets managed by the industry.

The report shows 52.1% of assets under management in all collective investment schemes are invested in government securities as at 31st December 2019.

“The digitization of Cytonn Money Market Fund as a high yielding wallet, immediately available 24/7 over the phone through *809#, which has the features of immediate redemption of up to Ksh150,000 directly to M-Pesa, and the ability to pay bills, has proven useful to our clients, and this has been demonstrated in the growth achieved,” said Mr Victor Odendo, Principal Officer, Cytonn Asset Managers Ltd.

SEE >> NSE Extends Suspension of Two Listed Companies

Cytonn Asset Managers Limited (CAML) is the regulated affiliate of Cytonn Investments Management Plc. CAML is licensed by the Capital Markets Authority and the Retirement Benefits Authority and its key focus is on fund management, Collective Investments Schemes and Investment Advisory.

A money market fund mainly invests in short-term debt securities with high credit quality such as treasury bills and commercial paper. This fund is ideal for the conservative low-risk investor who leans towards stability and security for capital invested. Interest is calculated on a daily basis, and credited to the client’s account net of costs.

Leave a comment