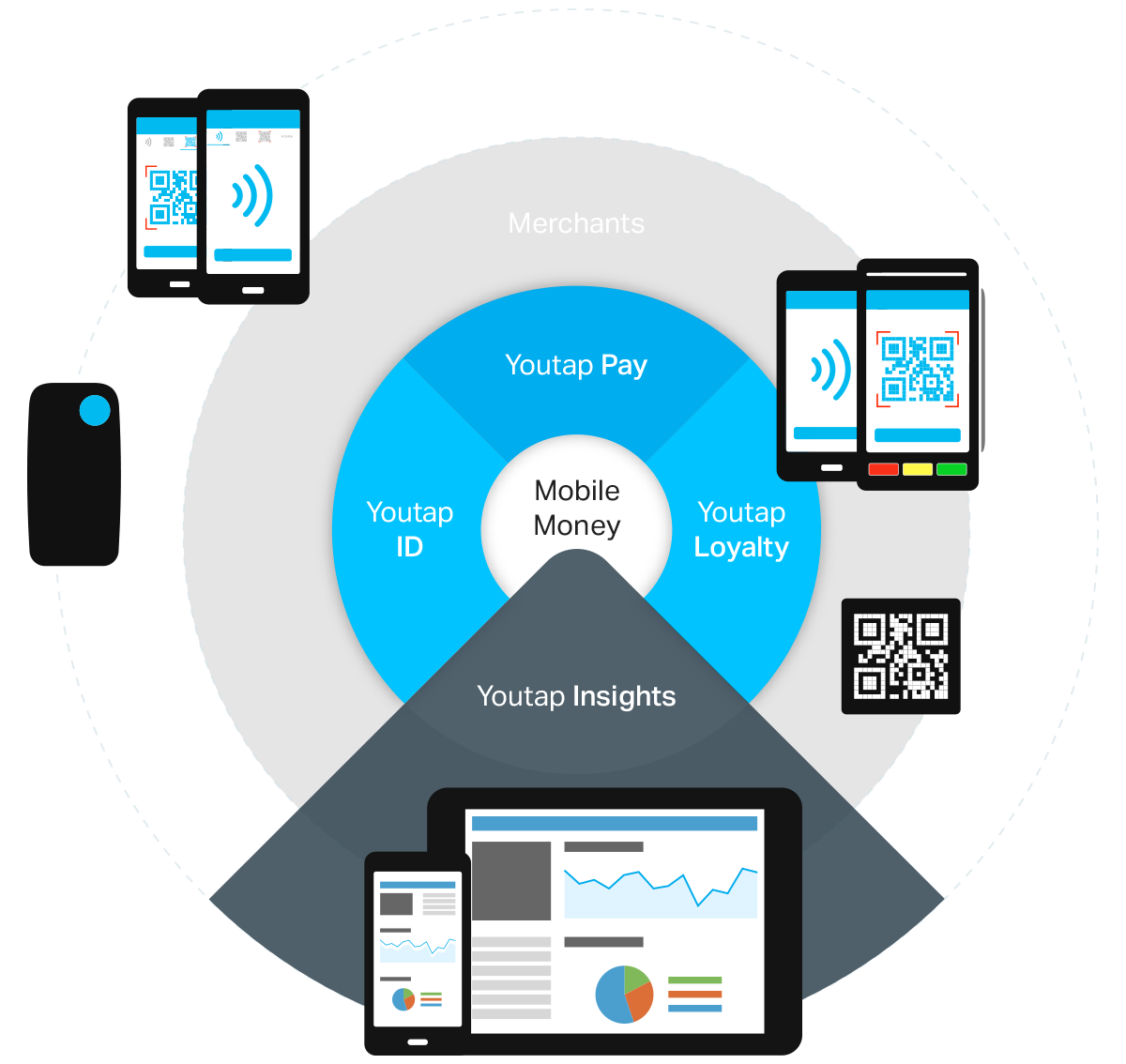

A New Zealand-based global provider of contactless mobile payments and financial services software, Youtap Limited, has launched mobile money quick response (QR) code solution and apps to enhance mobile money transfer growth within the Kenyan market.

The company has introduced new smartphone apps in Africa, Kenya included with an aim to ease mobile money transfer and is determined to penetrate the niche despite the presence of other forms of mobile money payments in the country. The company facilitates customers to enjoy a quick and easy transfer of money at any point through their smartphones.

The QR code innovation paves way for varied kinds of mobile money transactions such as cash-in and cash-out transactions, bill and in-store payments, airtime top-ups and could also be employed in giving back change in case clients opted to pay by cash.

In a press statement, Chief Executive Officer of Youtap Company Chris Jones said the solution would support both customer and merchant initiated QR code payments for the many smartphone users within the Kenyan market and the world at large.

“The solution conforms to the BharatQR industry standard developed by Bharat, MasterCard and Visa,” said Mr Jones, adding that the apps created by Youtap would be white labeled and have a logo and colors of the mobile money service.

Related: Kenyans moved Sh1.2 trillion via mobile phones in three months

He noted that the solution provided by Youtap would give all merchants or even the small business owners owning a smartphone the ability to download the App, register and accept mobile money payments. He urged any interested person to download the app and start using it to make payments.

On the other hand, there will be printed QR code allowing mobile money merchants who do not have a smartphone to enjoy the service.

A research conducted by Mobile Telephone Network (MTN) Group has indicated a tremendous growth in smartphone use in Africa. Their statistics depict a 15 per cent increase in South Africa, 36 per cent increase in Nigeria and a further 64 per cent increase in Ghana.

Furthermore, GSM Association (GSMA) asserted that the adoption of smartphone was likely to reach 50 percent come next year.

Leave a comment