Kenyans concerned about the financial impact of treatment for critical illnesses amid COVID-19 spread have a new option for protection.

Liberty Life Assurance on Wednesday released a critical illness plan with an optional rider that offers a lump sum benefit for hospitalization for treatment of cancer, heart attacks, stroke, final-stage renal failure, major organ-kidney, lung, liver, heart, or pancrease- transplant, and coronary artery graft bypass surgery.

Informed by its commissioned market study that reveals a growing worry on the soaring treatment costs associated with critical illnesses and Covid-19 spread, Liberty’s term-life plan, Hekima Plan, is aimed at financially supporting customers in the unfortunate event that such illnesses afflict them or their family members, especially during this pandemic when many of us could become very vulnerable.

Under the plan, the life assured will receive 30 percent of the lumpsum in the event that they are diagnosed with a critical illness, lessening the financial burden brought about by such illness.

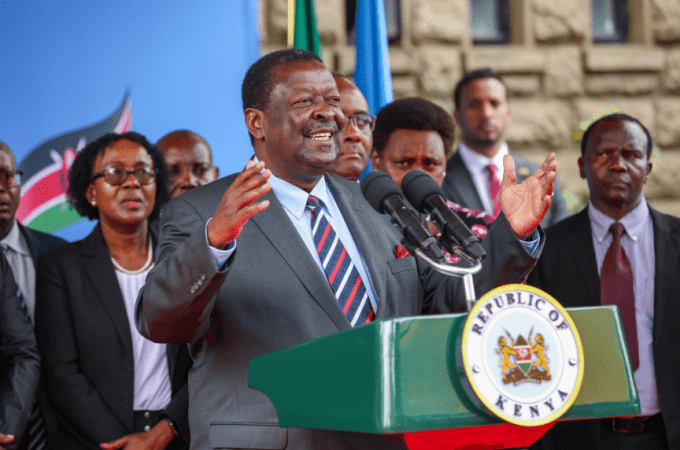

Abel Munda, Liberty Life Managing Director said: “Today many more people are surviving serious illnesses due to advanced medicine, but surviving the financial burden they create is a different issue. Critical illness insurance is an affordable option that can help breadwinners to protect themselves, their wealth and their families.”

For critical illnesses, the one-off payment saves the assured from crowd funding or asset selling, and allows the flexibility of managing medical expenses unavailable with traditional medical covers.

Besides the listed beneficiaries drawing a lumpsum amount on the death of the assured, they can also benefit from payments to the assured in case of a job loss or disability “This plan is built to protect wealth and gives the beneficiaries financial protection in the event that the family’s breadwinner is rendered economically unproductive by disabilities“, said Mr. Munda.

Disabilities covered include the permanent loss of sight in both eyes and hearing in both ears; permanent loss of speech; major burns; loss of two limbs and inability to perform four out of six Activities of Daily Living (ADLs).

The cover also offers the assured the benefit of an assured cashback, should there be no claim on the policy over the term chosen by the assured, calculated at 10 percent of the cover amount.

The plan’s minimum and maximum policy terms are 5 years and 16 years – while its minimum and maximum entry ages are 18 years and 60 years.

Leave a comment