half year results

Old Mutual Profits Nosedive in First Half of 2025

Old Mutual’s investment income rose impressively to Ksh 4.2 billion in the first half of 2025, up from Ksh 3.7 billion the year...

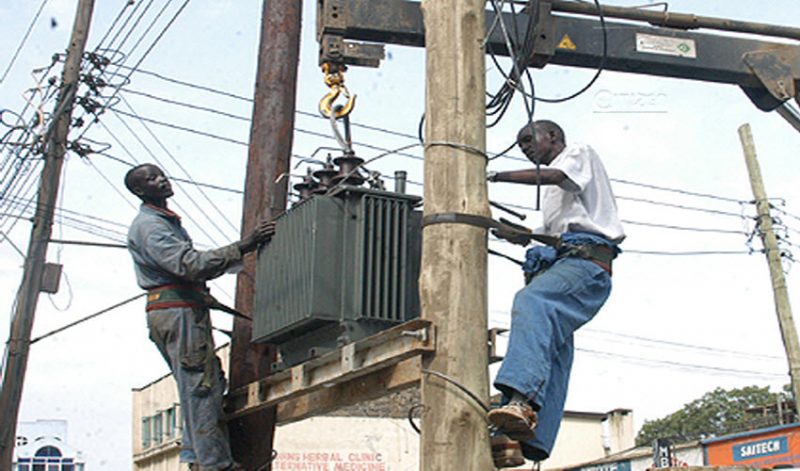

Kenya Power half year profits plunge amid dim 2017

Company says tough conditions in 2017 have occasioned a projected downward slide in earnings

Bamburi Cement half year profit down by Sh2 billion

Slide in market performance attributed to market conditions in Kenya and Uganda

Kenya Reinsurance profits drop in 2018 first half

Premiums also drop as corporation attributes factors contributing to the decline

NIC Group profit falls to Sh1.98 billion

The lender also paid dividends worth Ksh639.9 million last year

NSE half year profit jumps 72% to Sh133.7 million

Bourse records positive earnings amid robust market performance

KCB posts Sh12.1 billion profit

Half-year unaudited results released by the lender on August 16 indicate that the bank’s revenues grew to 12.1 billion

CIC Insurance Group posts Sh644m profit before tax in Half Year results

Gross written premiums increased by 18% from Ksh 7.6 billion in 2017 to Ksh 9 billion in 2018

Safaricom half-year profit hits Sh26bn

Chairman Nicholas Ng’ang’a said the company will continue to perform strongly despite Chief Executive Bob Collymore being on sick leave for specialised treatment