Financial services firm Sanlam Group has acquired PineBridge Investments, the asset management company, raising its stakes in the battle for the regional market. The acquisition of majority stake was made through its subsidiary, Sanlam Emerging Markets (SEM).

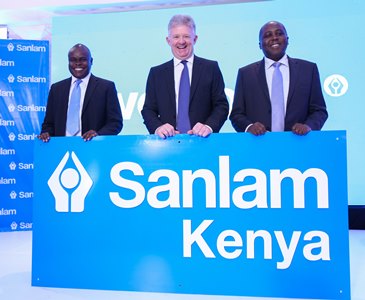

The transaction is subject to regulatory approval, after which PineBridge will be rebranded to Sanlam Investments East Africa Limited (SIEAL). PineBridge has operations in Kenya and Uganda. Sanlam Emerging Markets CEO Junior Ngulube says the acquisition will increase Sanlam’s asset management business and reach in the region for institutional, affluent and retail investment management across East Africa.

“We looked for a partner in Africa who could best continue to work with our clients on the continent,” said Mr Mr Anthony King, regional CEO, EMEA at PineBridge Investments. “And we are pleased to have been able to complete this transaction with Sanlam. At the forefront of our negotiations was the need to secure a buyer with a strong local heritage in order to maximise future business growth and honour fiduciary, client and employee agreements.”

The Sanlam Group is one of Africa’s largest financial services providers, with a market capitalization in excess of $ 11 billion (9th March 2017) and operations in 34 African countries.

Their investment management businesses have approximately $60 billion in assets under management. Sanlam offers a comprehensive range of local and offshore investment products to end-investors, financial planners and institutions. Its investment options include passively and actively managed unit trusts, hedge funds, and segregated and pooled retirement funds.

Mr Jonathan Stichbury, Chief Executive Officer of PIEAL added: “Becoming part of the Sanlam Group offers our clients and staff new opportunities. We look forward to working with Sanlam to create value for our clients and continue building the East African business.”

[crp]

Leave a comment