Olympia Capital Holdings Limited, the NSE-listed holding company with investments in companies dealing in the manufacture and sale of products used in the construction industry, was the top price gainer at the Nairobi Securities Exchange(NSE) on 7th October.

Its share price rose 10% to close at Ksh 2.31 with a traded volume of 100 shares and a turnover of Ksh 231.00. The stock has earnings per share of Ksh 0.11, price/earning ratio of Ksh 21.00 with a market capitalization of KSh 92.4 Million.

Olympia Capital began the year with a share price of KSh 2.01 and has since gained 14.93% on that price valuation, ranking it third on the NSE in terms of year-to-date performance.

Olympia Capital Holdings Limited has four market competitors who are also engaged in the Industrials sector. They are East African Portland Cement, Trans Century Limited, East African Cables Limited and Bamburi Cement Limited.

The firm deals with products such as floor tiles, adhesives, uPVC windows and door frames, cleaning chemicals, as well as fire prevention equipment, water pumps and real estate. Its subsidiary and affiliated companies include Dunlop Industries Limited, Olympia Capital Corporation (Proprietary) Limited, Kalahari Floor Tiles (Proprietary) Limited, Gaborone Enterprises (Proprietary) Limited, Avon Rubber Company Ltd and Mather & Platt (Kenya) Ltd.

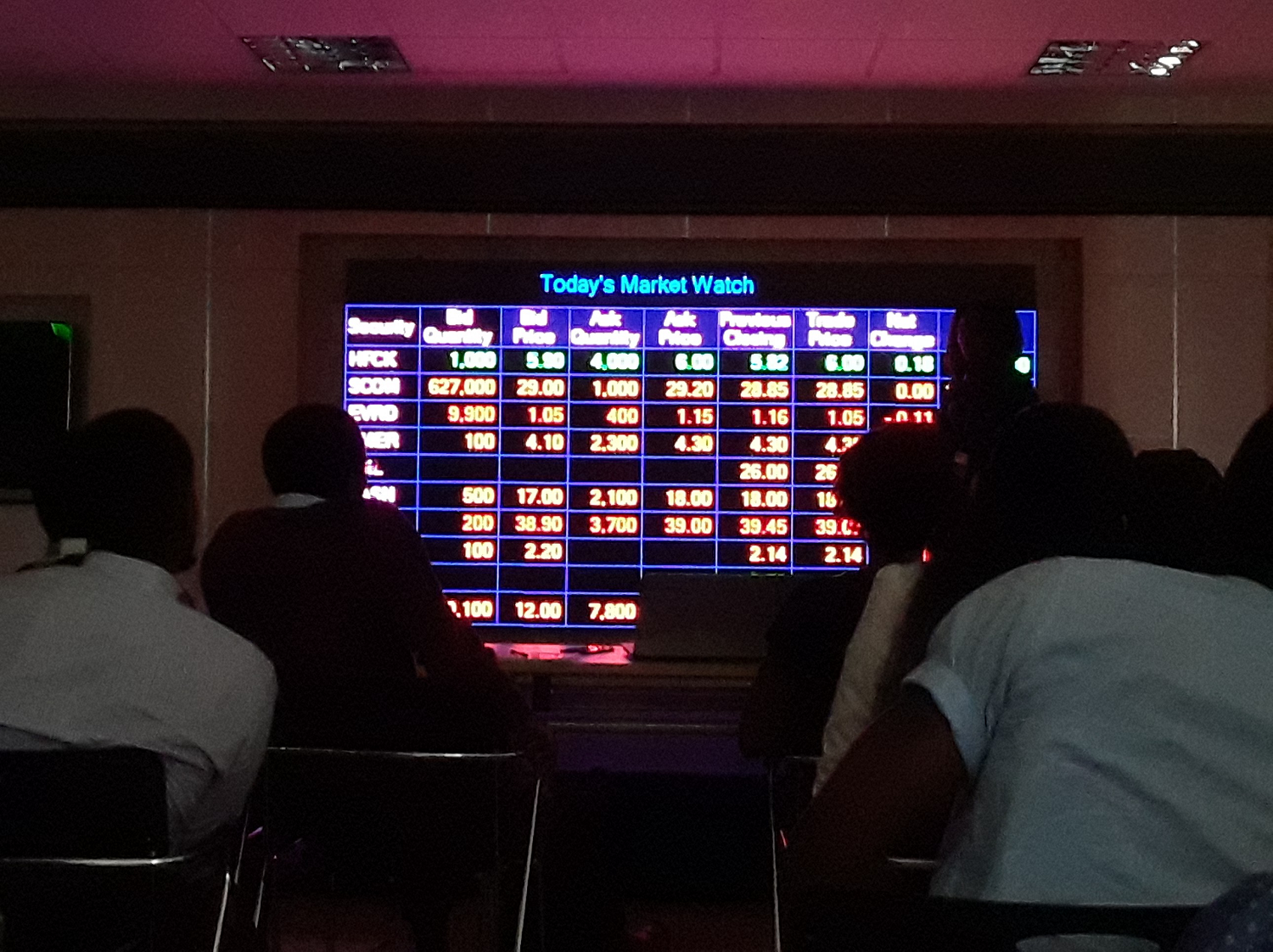

At the end of trading on 7th Wednesday, October 2020 a total of 9,133,300 shares in 924 deals, corresponding to a market value of KES 220,991,913.00, were transacted. This was a 13% improvement in volume, 4% improvement in turnover, and 27% growth in deals.

Apart from Olympia Capital Holdings, other gainers were E.A Portland Plc [PORT] (+7.74%), Stanbic Holdings Plc [SBIC] (+4.67%) and Umeme Limited [UMME] (+3.89%).

Losers were led by Sameer Africa with a price depreciation of 7.35% closing at KSh 3.53 per share, followed by Eveready E.A Plc, Flame Tree Group Holdings Plc and Bank of Kigali Group Plc [BKG] (-5.41%).

Safaricom Plc recorded the highest volume of 3.2 million traded shares, followed by Equity Group Holdings Plc (1.61Million), Bamburi Cement Plc (970,300), and Co-operative Bank of Kenya (680,700)

The benchmark NSE All-Share Index [NASI] gained 1.30 points to close at 141.02. The NSE 20 Share Index declined 6.59 points to close at 1,836.09. The NSE 25 Share Index gained 13.45 points to close at 3233.86

There were no contracts concluded on the derivative market. The secondary bond market traded bonds worth KSh3.81 billion transacted in 75 deals in as compared to the KSh2.56 billion achieved in 43 deals during Tuesday’s trading session.

Leave a comment