Technology-driven agricultural start-up, ThriveAgric, has emerged as the winner of the Central Europe, Middle East, and Africa (CEMEA) Visa Everywhere Initiative (VEI), a global innovation program and competition for start-ups and fintech companies.

See >> First Kenyan To Bank a Billion Rose From Humble Beginning

With this win in the CEMEA region, ThriveAgric will receive a monetary prize and a spot in the Global Finale scheduled to be held in Qatar, in November 2022. Carepay, another Nigerian fintech also made it to the final five and won the Audience Favourite Award.

More than 1,300 applicants entered the competition from across the region, each with solutions aimed at delivering innovative payment and commerce solutions to consumers and businesses.

“We have witnessed substantial growth in the fintech sector in Nigeria. Last year, Nigeria had the most entries from Central Europe, Middle East and Africa, this year two indigenous startups made it to the finals with ThriveAgric emerging the winner. This is a clear demonstration of the country’s significance in the fintech sector, and the growth potential of the digital economy” said Andrew Uaboi, Country Manager, Visa Nigeria.

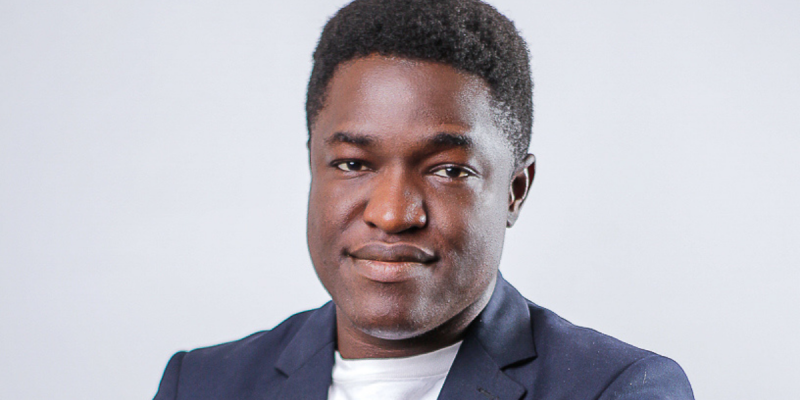

Ayo Arikawe, Co-Founder, ThriveAgric, said agriculture is at the centre of the Nigerian economy, yet the sector faces productivity-limiting challenges like access to finance, poor access to the market, and technical know-how.

“This is why our goal at ThriveAgric is to provide profitable support for smallholder farmers and enable food production efforts, leveraging technology. So this partnership with Visa is a testament to the work we have put in so far and we look forward to scaling our solutions to more farmers,” said Mr Arikawe.

ThriveAgric is a technology-driven agricultural company passionate about food security, that enables strategic partnerships with financial institutions & agriculture value chain players to provide smallholder farmers with capital (in form of agriculture inputs), data-driven best practices, access to local & global markets for their commodities, as well as financial, e-commerce, and payment services.

CarePay is an aggregator of health services, driving accessibility and affordability of healthcare services through insurance and discount plans.

Read >> How Two Partners Built a Multi-Billion Real Estate Empire

Leave a comment