It is no longer business as usual for the insurance industry as customers are becoming more enlightened.

Aware of their insurance needs, customers are increasingly being sceptical of what insurers have to offer them, forcing a rethink by the insurers on the need to look for ways of remaining relevant in the competitive scene.

This means that the insurance providers have to come up with solutions that not only look at the takers but also ones which offer an improved environment in their operational efficiencies using technology.

Feeling the tech disruption heat

The Insurance Outlook Report 2019/2020 East Africa by Deloitte notes: “The first insurers who capitalise on the opportunities that digitisation and automation offer will most likely be the biggest beneficiaries.”

While the pace at which disruptive technologies have been taken up by incumbents and the entrance of non-traditional insurers in the market is slower than expected, the report underscores the importance of changing with the times if the sector is to remain competitive.

“Globally, insurers have taken steps to modify their product and service offerings in line with customer behaviours.”

The disruptive trend is yet to be experienced in the insurance sector in East Africa but this is just a matter of time.

Already, other industries such as banking, transportation and manufacturing have already started feeling the effects of disruptive technologies and unconventional competitors.

“It is up to insurers to start small without fearing to fail and make iterative changes to their business as usual approaches,” cautions the report.

Competition and dwindling returns

The outlook adds that insurers in the region have experienced better times than their financial performance in recent years.

However, the sustained economic growth in the region has not translated into a positive trajectory for insurers.

Insurers are revising premium rates downwards in the more competitive business classes even as the operating environment becomes more competitive.

Read Also >> Insurance Finds Affordable Solution for Infertile Couples

Insurance companies have also suffered dwindling fortunes as they have registered suboptimal investment returns on property and equity markets.

The companies were using these returns as a safety net to compensate for underwriting losses.

Interestingly, the operating environment has remained largely unchanged in the insurance industry.

To survive though, the report says that “it is up to insurers to start small without fearing to fail and make iterative changes to their business as usual approaches”.

Economic performance in Kenya

The report notes that according to the Economist Intelligence Unit (EIU), Kenya’s real GDP increased to 6.3% in 2018 due to the strong agricultural performance and it is expected to moderate to 5.7% in 2019.

This is mainly due to the late start of the rainy season having an impact on the agricultural performance of the country.

Nonetheless, growth in 2019 will be supported by public and private investment, regional integration and communication services.

EIU predicts that the real GDP growth in Kenya will remain strong, averaging 5.9% a year in 2020-23. This is supported by urbanization, regional integration, structural reforms and investment in infrastructure.

Pension business has had growth since 2014 due to the increased demand and uptake of retirement and savings products.

Deloitte Report

Inflation fell to 4.7% in 2018 due to favourable rains and stable food prices but is expected to be higher in 2019 due to poor rainfall and the rising cost of food.

In the long term, inflation is expected to average 6.6% a year in 2020-23 mainly due to rising global oil prices and the threat of drought. However, prudent monetary policy will offer some protection.

Based on our internal projections and the historical relationship between gross written premium growth and GDP growth, the insurance industry is expected to experience growth in gross written premium in line with historically observed growth rates.

Insurance sector performance

The report notes that in the last five years, the life insurance market in Kenya has experienced growth in both the level of direct premiums as well as in the equity held by the industry constituents.

There has been a record of positive returns on shareholder’s equity in this time frame. However, the return on equity has been varying year on year with a decline recorded in 2017 to 2018.

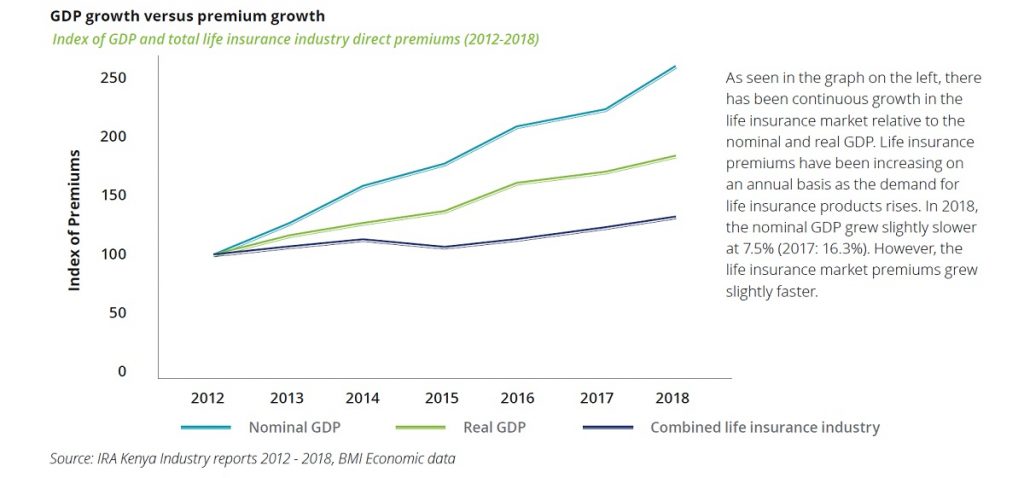

The report shows a correlation between GDP versus premium growth.

“There has been continuous growth in the life insurance market relative to the nominal and real GDP. Life insurance premiums have been increasing on an annual basis as the demand for life insurance products rises. In 2018, the nominal GDP grew slightly slower at 7.5% (2017: 16.3%). However, the life insurance market premiums grew slightly faster.”

The insurance sector saw declines in the overall direct premiums for both ordinary and group life businesses in 2018 but the possible effects were counteracted by the increase in pension business direct premiums.

“Group life has experienced a slower growth rate in comparison to other business classes within life insurance due to the price wars that have been prevalent among the industry players,” notes the report.

However, it adds, “pension business has had growth since 2014 due to the increased demand and uptake of retirement and savings products.”

Insurers have remained in traditional business classes despite loss-making behaviour.

Motor private and medical classes are the largest classes and among the most loss-making businesses. The insurers could investigate other emerging business classes that have the potential for growth to diversify their business mix. “Alternatively, insurers need to investigate means of reducing the loss ratios on the large business classes using big data and AI.”

Next Read >> Kenya’s Most Controversial Editor is Back at Standard Media

Leave a comment