Kenya Airways has welcomed the move by the National Treasury to endorse a proposal to nationalise the national carrier, saying it is what is necessary to enable it compete on a level playing field.

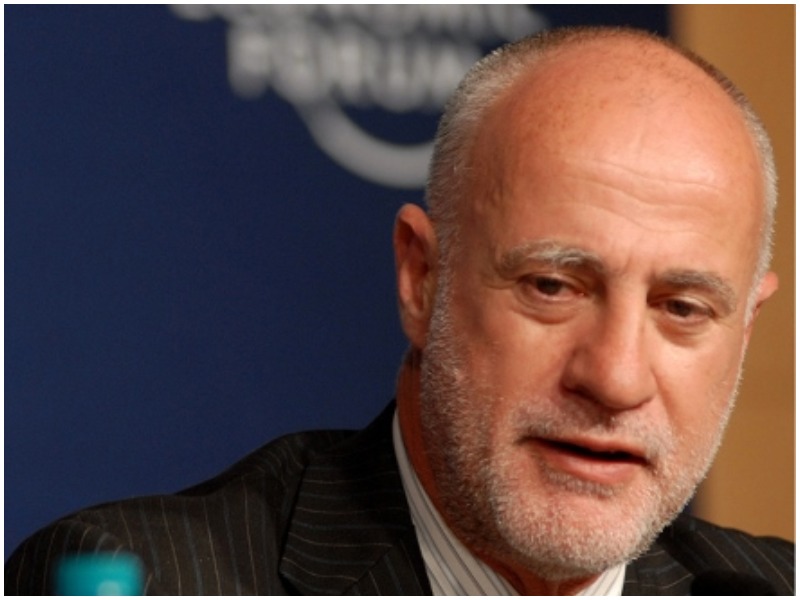

“Nationalisation is what is necessary to compete on a level playing field. It is not what we want, but what we need,” chairman Michael Joseph told the Reuters news agency, referring to competitors such as Ethiopian Airlines which are state-run and profitable.

Joseph said the vote was “great news”. However, Air France-KLM, which holds 7.8% of the KQ shareholding, could not immediately be reached for comment by the news agency. The airline is 48.9% government-owned while 38.1% is owned by KQ Lenders Company 2017 Ltd, a consortium of banks it owes billions of shillings.

Transport Principal Secretary Esther Koimett said the government will now draw up an implementation plan, with clear time lines. Kenya is seeking to emulate countries like Ethiopia which run air transport assets from airports to fuelling operations under a single company, using funds from the more profitable parts to support others, such as national airlines.

The loss-making airline has been struggling to return to profitability and growth. A failed expansion drive and a slump in air travel forced it to restructure $2 billion (R27.78bn) of debt in 2017.

The airline later proposed taking over the running of the Jomo Kenyatta International Airport to boost its revenue.

Read: Nation fights back to stop political reporter from joining People Daily

The National Assembly Transport Committee, however, rejected that plan, recommending instead the nationalisation of the airline. On Tuesday, majority of lawmakers voted to accept the report.

Leave a comment