Google has announced new policy changes affecting loan apps hosted on its Play store. The company’s updated personal loans policy states that apps aiming to provide or facilitate personal loans may not access user contacts or photos.

The changes will take effect on May 31, 2023. The measures are expected to enhance privacy and data protection efforts.

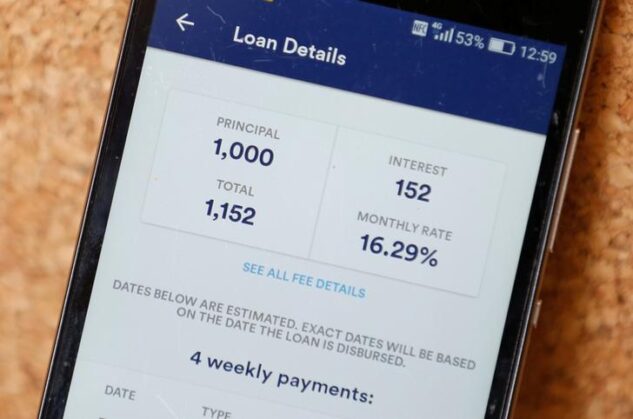

Many loan apps in Kenya require users to grant them access to their contacts before a loan can be disbursed. This data is often used by loan apps in ‘debt-shaming’ of defaulters, with the company spamming borrowers’ contacts with messages and phone calls over their debts.

In addition, the apps often request users to verify their identity by taking a photo before disbursing personal loans. These images can also be misused by loan apps.

Google earlier this year announced that it would no longer allow loan apps without proof of licensing from the Central Bank of Kenya (CBK) on its app store. The Central Bank of Kenya (Amendment) Act, which came into effect in December 2021, brought all digital lenders under the supervision of the apex bank – with tough new regulations introduced to rein in the industry.

READ>Civil Servants’ Pain as Broke GoK Delays Salaries

In March, hundreds of loan apps in Kenya were removed from the Play store as a result of the policy shift. The law bars practices including unethical debt collection practices, and the abuse of personal information.

The Central Bank of Kenya in March licensed 10 additional digital credit providers, bringing to 32 the total number of digital lenders licensed to operate in the country.

The CBK said in a statement disclosed that it had received 401 applications since March last year and that other applications are at different stages in the licensing process. The CBK has previously noted that it was working with the Office of the Data Protection Commissioner in the licensing process.

NEXT>My County App: Counties, Safaricom Team Up to Digitize Services

![The National Treasury is yet to disburse funds to counties, or pay salaries for civil servants with the exception of teachers and members of the disciplined forces. [Photo/ KNA]](https://businesstoday.co.ke/wp-content/uploads/2023/04/KENYA-NATIONAL-TREASURY-BUILDING-150x150.jpg)

![The ODPC disclosed that it had received around 150 complaints relating to Whitepath and its unethical practices. [Photo/ BBC]](https://businesstoday.co.ke/wp-content/uploads/2023/04/120498174_gettyimages-926653278_976549.jpg)

![Examples of digital loan services are Safaricom's M-Shwari and KCB M-Pesa, as well as loan apps such as Tala (pictured), Branch and Zenka. [Photo/ JITIMU]](https://businesstoday.co.ke/wp-content/uploads/2022/08/mobile-loan-apps-min.jpg)

Leave a comment