A Facebook page using the name Tala Loans is neither owned nor run by Tala, a mobile loan company operating in Kenya.

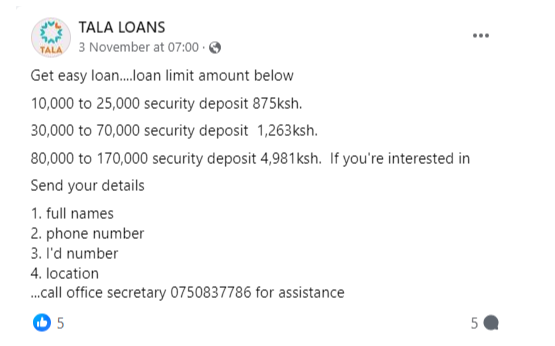

The page, which had over 20,000 followers as of Thursday, November 9, 2023, promised loans to clients who made deposits of certain amounts.

For example, for loans between Ksh10,000 and Ksh20,000, users are required to make a deposit of Ksh875.

The page, in a post dated November 3, 2023, promised loans with different ranges to customers who make deposits to corresponding amounts.

Business Today has fact-checked the page and found it to be fake being run probably by scammers.

The page, according to transparency information, was created on July 1, 2021, while the authentic Tala page, which is verified, was created on June 12, 2014.

The fake page only shares a phone number as its contact info, while the authentic page shares all its contact info including phone number, email address and links to all its official social media accounts.

The fake page offers loans through a phone number, while Tala has an app which is used to offer loans.

Responding to queries by Business Today, Tala confirmed that the page was fake and had been previously flagged.

“Thank you for contacting Tala and for alerting us. The page you have shared is not our genuine page and it has already been flagged. Our social media team will be further following up on it,” Tala told Business Today in an email.

On July 25, 2022, Tala, through its verified Facebook page, said that it only offers loans through its app.

“Tala’s loan application process is only in the Tala app,” Tala stated.

The page, named Tala Loans, is, therefore fake.

This fact check was published by Business Today with technical support from Code for Africa’s PesaCheck newsdesk, through the African Fact-Checking Alliance (AFCA).

Leave a comment