The government-backed Central Bank of Kenya (CBK) Amendment Bill of 2020 has continued to chug along in Parliament, proposing a raft of far-reaching changes for the digital lending sector.

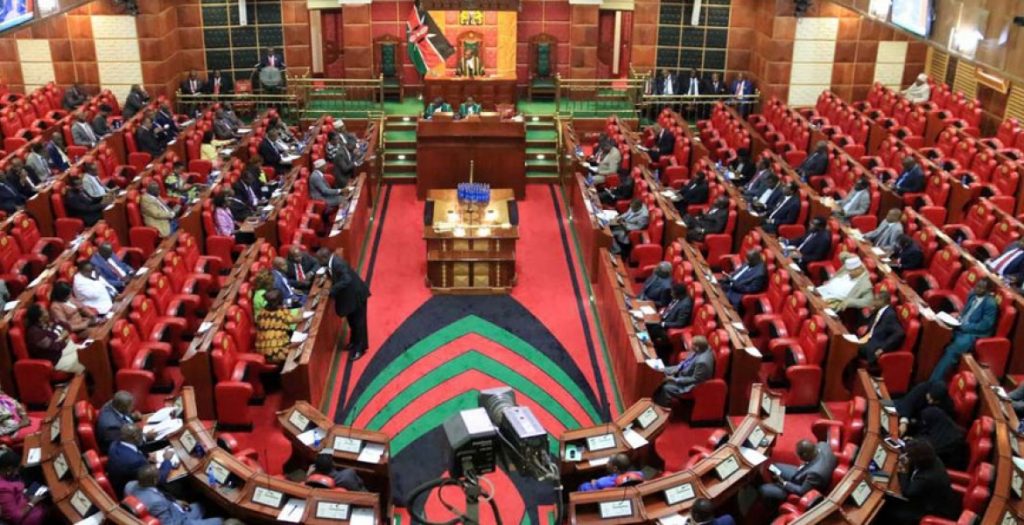

Introduced by Nominated MP Gideon Keter, the bill made its way to the the National Assembly committee on Finance and National Planning, chaired by Homa Bay Woman Representative Gladys Wanga. It aims to rein in the previously unregulated mobile lending sector, which has been accused of unethical practices including exploitative lending, debt shaming, money laundering and illegal mining of private customer data.

In one of the biggest changes proposed in the bill, meant to curb the high interest rates offered by the apps – CBK will be required to determine minimum liquidity and capital adequacy requirements for digital credit providers, similar to regulations for operating a bank.

Annualized interest rates on some lending apps is as much as 520 per cent – a situation that has fueled accusations of predatory lending. The digital lenders have also been accused of failing to avail crucial information on loan details, repayment timelines and procedures.

The bill represents the latest step to tame the industry which has experienced massive growth in the past decade – backed by deep-pocketed investors including successful Silicon Valley figures. In April, CBK barred unregulated digital mobile lenders from forwarding the names of loan defaulters to credit reference bureaus (CRBs).

Should the bill become law, the apps will also need the CBK’s approval to roll out new products and pricing including loan charges.

READ ALSO>>>>>Mobile Loans: New Bill Changes Lenders’ Playbook

The management of digital loan providers will also have to be vetted by the CBK.

The digital lenders will also have to make disclosures to the CBK on the source of funds they are lending, part of the plan to stop illicit cash flows and money laundering

Those who fail to comply with the new regulations will face a fine of Sh5 million or a jail term of three years or both.

Digital credit providers will have six months to register with the Central Bank of Kenya (CBK) should the Bill sail through and be assented to by the President.

Questions have been raised on the ability of various digital credit providers currently operating to keep up with the new rules. Some analysts reckon that should the rules take effect, many of them will be pushed out of the Kenyan market.

“The principal object of this bill is to amend the Central Bank of Kenya Act in order to ensure the Central Bank of Kenya regulates the conduct of providers of digital financial products and services and financial products and services.

“The current position is that there is no legal framework governing digital borrowing platforms and other financial products and services. As such, the Central Bank of Kenya will have an obligation of ensuring that there is a fair and non-discriminatory marketplace for access to credit,” the bill read in part.

Leave a comment