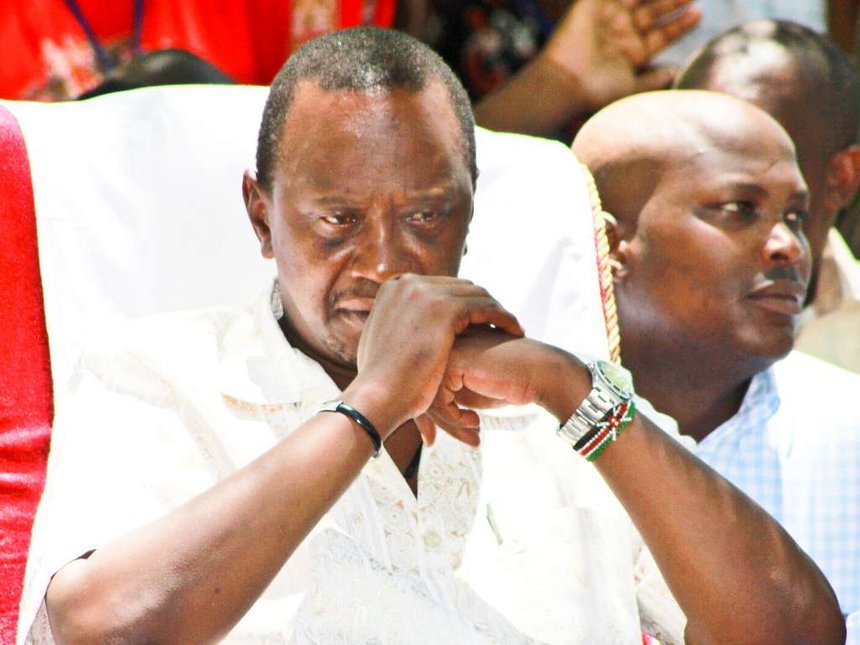

Economists have scoffed at President Uhuru Kenyatta’s claims that the public debt that the Jubilee Administration has incurred has been used to expand the country’s economy.

President Kenyatta has thus far remained defiant that his administration has allocated the borrowed money to stimulate the economy by closing the country’s huge infrastructure gap.

Speaking during a press briefing on Tuesday, ICEA Asset Management Head of Research Judd Murigi said that the country’s stock of public debt has largely been driven more by recurrent expenditure at both levels of the government.

“Recurrent expenditure may have comprised over 70% of national government spend between 2013 and 2018 accounting for the majority of increase in debt,” said the researcher.

According to Murigi, devolution has had a negative effect on the country’s economy with most counties unable to maintain the fiscal discipline required to effectively run the government .

The researcher says that the increase in public debt by Ksh2.7 trillion between 2013 and 2018 reflects the excess of government expenditure to the tune of Ksh9 trillion against revenue collections of Ksh6.2 trillion.

{Read: Counties to be hit with drug shortage due to huge debts}

“Recurrent expenditure compromised almost 60% of the total government spend of Ksh9 trillion while development expenditure accounted for one quarter of government spend while county allocations constituted 15% at Ksh1.3 trillion over the past five years,” said Murigi.

Murigi’s comments back Director of Research and Planning at the Office of the Controller of Budget Joshua Musyimi’s claims that the government is struggling to pay salaries over the huge public debt.

Appearing before the senate Finance Committee, on February 21, 2019 Musyimi expressed his concerns over the government’s insatiable borrowing appetite and just fell short of saying that the country was headed for an economic crisis.

{See also: EAC partner states hosts high level Oil & Gas stakeholder forum}

“We are collecting Ksh1.6 trillion as revenue every year and servicing debts to the tune of Ksh1.1 trillion annually. What we are left with cannot even pay salaries,” Musyimi told the legislators.

14 Comments