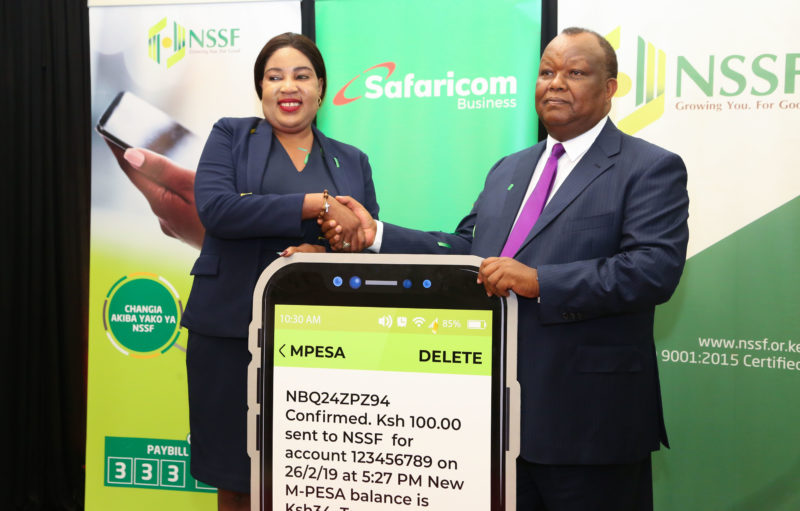

You will from now on be able to remit your National Social Security Fund (NSSF) contributions via M-Pesa.

Under the initiative, NSSF will implement an entirely cashless system at all its branches across the country. The Fund is seeking to increase the convenience and efficiency of its services through the automation and digitization exercise.

“The platform we are launching today, will make contributing to NSSF easy and effortless, We are aware that we have an enormous task ahead in meeting public expectations in our new role as a pension fund and I wish to assure you that the fund is striving to enhance the member experience and we have a couple of initiatives that we shall roll out in the next couple of months,” said Chairman Board of Trustees, NSSF Gen. (Rtd) Dr. Julius Karangi during the launch of the service on Monday.

Under the new system, NSSF members can now remit their contributions and other payments to the organisation through the M-Pesa.

“We are proud for NSSF to have selected Safaricom as a partner in their shift to fully automated and cashless operations. More of our enterprise customers are adopting digitization as they increasingly focus on their customers’ needs. By cutting down on time spent handling and reconciling cash payments, the NSSF and its members can now enjoy the benefits of increased operational efficiency,” said Rita Okuthe, Chief Enterprise Business Officer, Safaricom.

Through this partnership, employers with 20 and fewer employees can now also make their staff contributions through M-Pesa. To contribute, the employer uploads their payroll data to the NSSF portal, after which they generate the Unique Payment Number (UPN) as part of their payment order. The employer then keys in the UPN as the Account Number under M-Pesa.

Read: Huawei CFO takes the fight to Canada

In addition to launching the cashless platform NSSF is also enhancing the ease of doing business where returns will only be filed online from today.

Mobile payments have emerged as the most popular mode of cashless payments with data from the Central Bank showing almost nine of every ten cashless payments in the country were on the mobile phone as of December 2018.

See also: John Njiraini’s eventful tenure as taxman comes to a close

According to a GSMA report, citizens prefer mobile payments for government services due to the associated cost savings of up to more than 75 per cent.

1 Comment