Mauritian bank SBM Holdings has concluded the acquisition of Chase Bank, effectively ending the bank’s two year receivership.

This after the bank signed a transaction agreement with the Kenya Deposit Insurance Corporation (KDIC) that will now see SBM Bank acquire a majority of Chase Bank’s assets and deposits.

Under the agreement, Chase Bank customers will have access to 75% of the Ksh 76 billion in deposits once the bank is re-opened.

“This concludes the discussions between SBM, KDIC and CBK on the CBLR transaction that was announced on January 5, 2018,” KDIC and the Central Bank of Kenya (CBK) said in a statement

In the agreement, customers will have immediate access to 25% of the deposits.

With the payments staggered, a further 25% of the deposit owed will be transferred into an interest earning savings account which the customer will also have access to.

“A further 25 percent of each transferred deposit will be held in a savings account with SBM Kenya at an interest rate of 6.65 percent per annum, with unrestricted usage,” KDIC said.

The remaining share will be put in a fixed deposit account for a three year period also earning a 6.65% interest per annum.

The central bank of Kenya said SBM would announce when the new accounts will become effective.

The deal will be welcome relief to the close to 3,100 affected depositors.

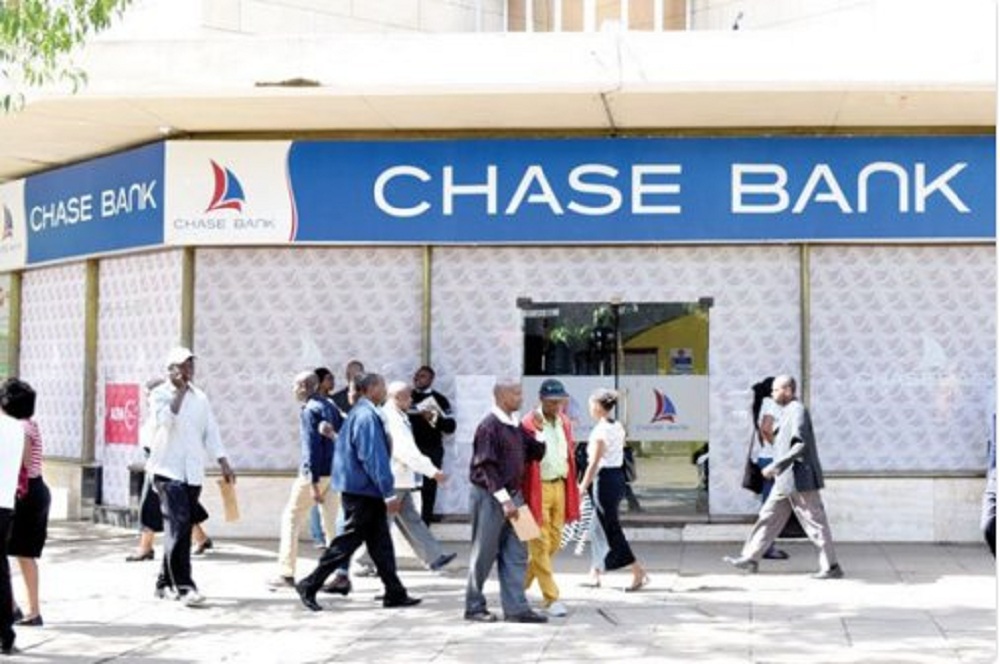

Chase Bank has been operating partially since April 2016, after it was re-opened under KCB receiver management.

SBM already has operations in Kenya after it acquired Fidelity Bank in 2016 with the expansion through Chase Bank aimed at tapping its growing its presence in the market.

“Through this acquisition, and combined with its other operations in Kenya, SBM will bring its experience and expertise from Mauritius and other markets, to further enhance the competitiveness and resilience of Kenya’s banking sector,” the statement reads.

Chase Bank was placed under receivership in April 2016 following a run on deposits after reports of liquidity problems.

According to KDIC, SBM will also be required to retain a majority of the Chase Bank staff and branches.

Story credit: Citizen Digital

Leave a comment