Kenya’s forex exchange reserves surged by US$30 million in the last week as inflows from foreign investors into the east African nation rose.

The dollar reserves, which had in previous weeks been on a downward trend, rose to US$7.12 billion, an equivalent of 4.8 months of import cover, at the end of last week, Central Bank of Kenya (CBK) data showed Monday.

At the end of November, the foreign exchange reserves stood at US$7.09 billion, an equivalent of 4.7 months of import cover. The reserves fell from a peak of US$7.5 billion in September.

There has been an increase in inflows in Kenya, especially from foreigners investing at the stock and debt markets in the last one week.

READ: NMG confirms Joe Muganda’s exit as CEO

Foreigner investors, especially at the stock market, traded mainly in leading telco Safaricom, pushing it to a new high of US$0.26.

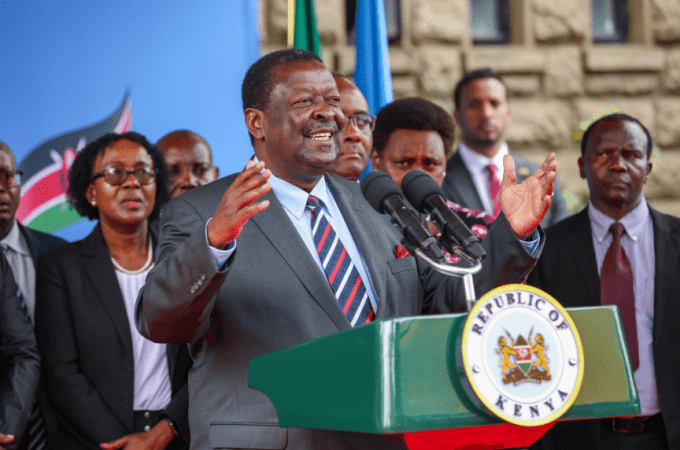

Analysts have attributed the rise in the foreign exchange reserves to improved business environment following the swearing-in of President Uhuru Kenyatta after a lengthy electioneering period.

With the increased dollar reserves, the apex bank is in a good position to support the Kenya shilling in case it faces pressure from international currencies. The shilling is currently trading at an average of Ksh 103.00 to the dollar.

Leave a comment