Insurance broker, Minet Kenya has today unveiled an insurance cover that allows small and medium enterprises (SMEs) in Kenya to mitigate against risks they feel most vulnerable for as low as Ksh5,000.

The cover, dubbed BiznaSure, is a comprehensive and customizable insurance policy that allows SMEs to choose the type of insurance they need, based on their specific risks and business requirements. The cover is underwritten by Fidelity Insurance.

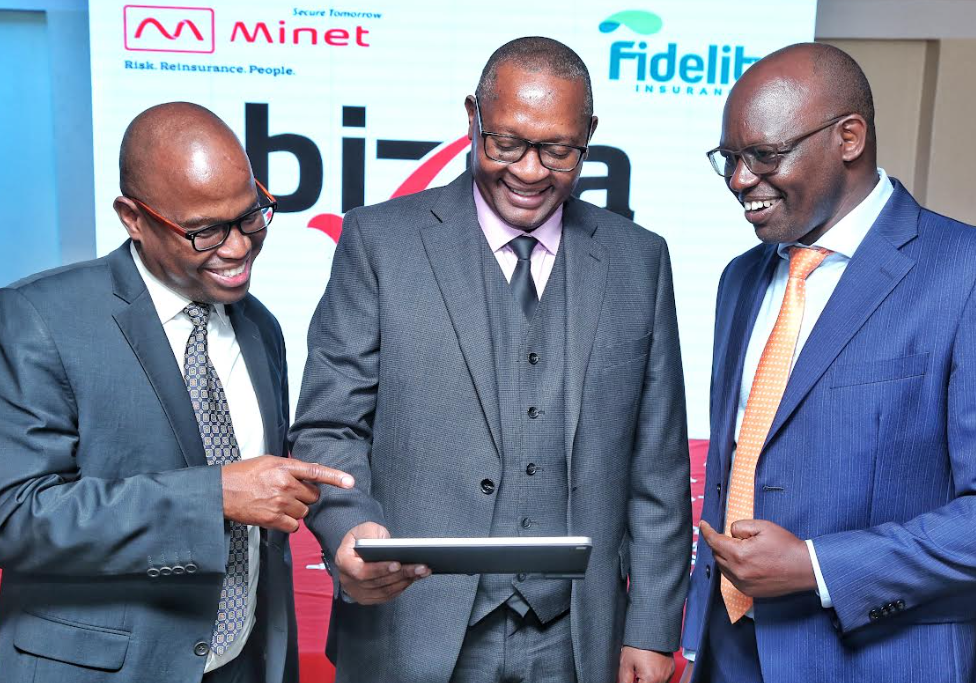

Speaking during the launch event, Minet Kenya’s Chief Executive Officer, Sammy Muthui affirmed the insurance firm’s commitment to continue developing and offering innovative solutions that cater for the needs of every Kenyan business.

“We are giving SMEs the power of choice and access to the same level of protection as larger businesses, at affordable rates,” said Mr Muthui.

Fidelity Insurance CEO, Richard Marisin said:” Biznasure offers unique, differentiated, and customized comprehensive coverage options to cover against property damage, liability, theft, business interruption and various other risks which may affect the owner, employees and third parties. In a nutshell, Biznasure protects you against a broad spectrum of risks.”

The Ministry of Industrialization, Trade and Enterprise Development says there are approximately 7.4 million MSMEs in Kenya, accounting for roughly a third (24%) of the country’s GDP. Though impressive, that contribution is far lower than, for example, that of South Africa at 55%, indicating there is still an opportunity to grow the sector.

“Kenya’s SME sector remains an untapped market for insurance products. And as the economy continues to recover, we expect demand for business insurance to grow as enterprises seek to protect themselves from uncertainties as seen with COVID-19,” added Mr Muthui.

The Insurance Regulatory Authority Chairman Mwambu Mabongah commended the broker for the new move and added: “The launch of the product is indeed a welcome addition to the range of insurance products that are being introduced to the market to meet the varied needs of Kenyan consumers and enterprises.”

Kenya National Chamber of Commerce and Industry President Richard Ngatia urged SMEs to take advantage of the solution by Minet and Fidelity to mitigate unforeseeable risks. “I invite Minet to work with our chamber in supporting SMEs in enhancing financial inclusion and ensure sustained businesses through mitigation strategies as offered by this cover.”

The event was also graced by Insurance Regulatory Authority CEO Geoffrey Kiptum who commended the partnership and urged Kenyan SMEs to embrace insurance covers.

The announcement comes at a time when Kenya’s economy is projected to grow by 5.3 percent this year, according to the latest International Monetary Fund (IMF) projection, signalling the recovery of SMEs in a post-pandemic era.

Read: Minet Group, Africa Lighthouse Capital Acquire Aon Botswana

>>> Minet Enlists More Hospitals For Teachers’ Medical Scheme

Leave a comment