It is now possible to withdraw your Fuliza overdraft at an M-Pesa agent. Previously, Fuliza overdrafts could only be used to send money to another number (even with insufficient funds in your M-Pesa wallet), buy airtime, or to pay for goods and services using Lipa na M-Pesa.

In the changes being rolled out, however, one is able to withdraw their available Fuliza overdraft just as they would their regular M-Pesa wallet balance. Regular withdrawal fees still apply, and will be deducted from your available overdraft limit.

The ability to withdraw Fuliza cash will be welcomed by users of the service – many of whom often have to resort to sending money they access on Fuliza to a different subscriber who can subsequently withdraw it for them. Some businesses today even offer ‘Fuliza numbers’ where those using the overdraft service can send the cash for withdrawal on their behalf, at a fee.

Fuliza is one of the best-performing mobile lending products in Safaricom’s portfolio, with far higher disbursement values than M-Shwari and KCB M-Pesa. The value of disbursements on Fuliza rose from Ksh246.6 billion in 2020 to hit Ksh351.2 billion in 2021.

On the other hand, Ksh94.5 billion was disbursed on M-Shwari in 2021 and Ksh51.1 billion on KCB M-Pesa. While Fuliza revenues grew 31% in 2021, M-Shwari and KCB M-Pesa revenues fell 13.4% and 18.7% respectively.

READ>Elon Musk to Disrupt Safaricom, Zuku in 2023

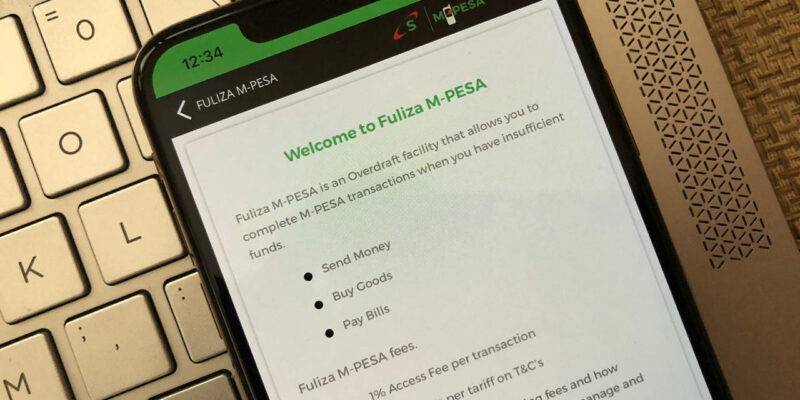

Fuliza is offered by Safaricom in partnership with NCBA and KCB banks. Subscribers get a Fuliza limit based on their transaction history on M-Pesa.

It charges a 1% access fee as well as daily maintenance fees.

Fuliza in September last year announced the introduction of a new discounted tariff on the service. The new tariff kept the access fee for all drawdowns unchanged at 1% but slashed daily maintenance fees (DMFs). Daily fees for the tariff bands Ksh101-500 and Ksh501-1000, fell by 40% – from Ksh5 to Ksh3 and from Ksh10 to Ksh6 respectively.

NEXT READ>Former Safaricom CEO Takes A Swipe At Fuliza

Leave a comment