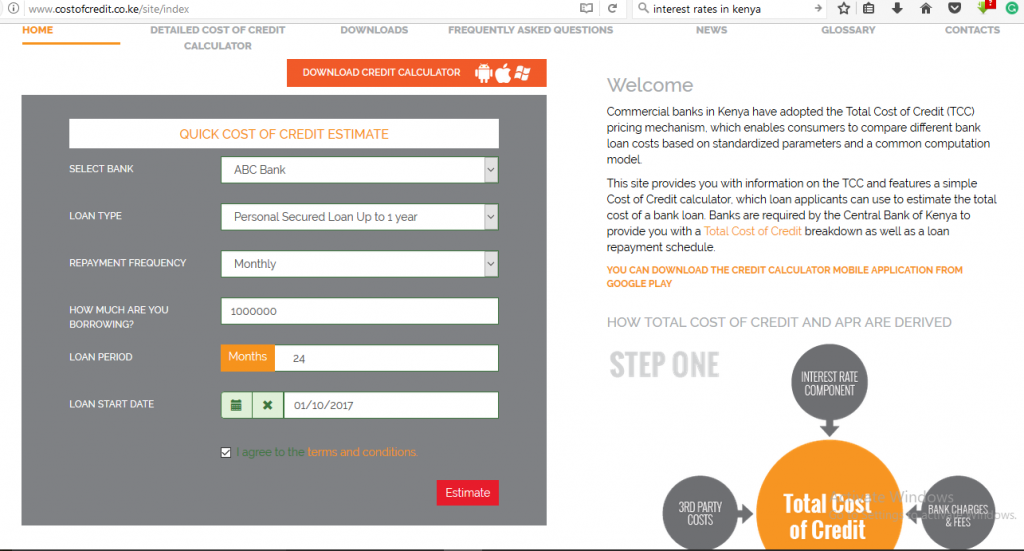

Here is a breakdown of the simple loan calculator on the Cost of Credit homepage. It has all the banks in Kenya included, and once one makes a rough estimate, it provides five other bank alternatives that one can consider.

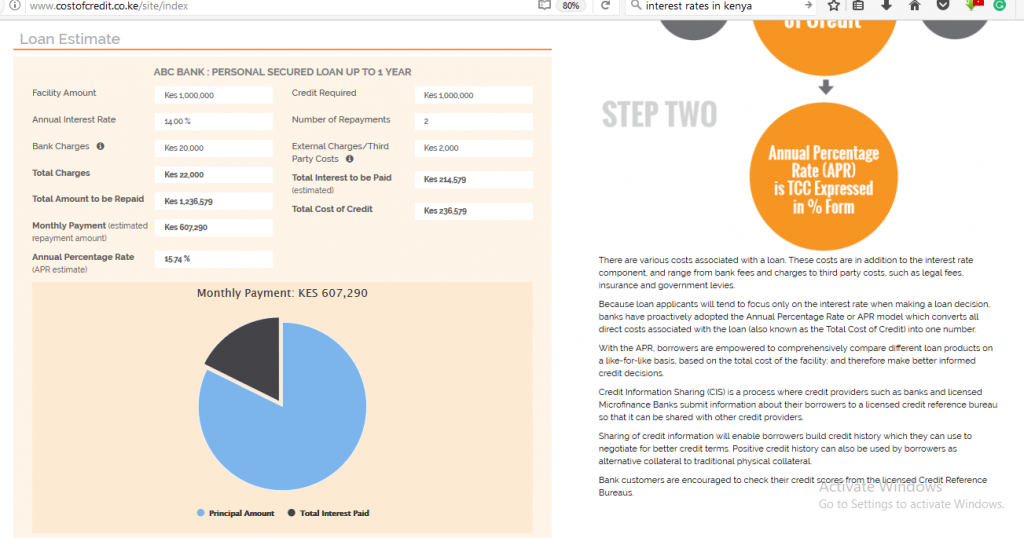

For example, acquiring a personal secured loan of Ksh1,000,000 from ABC bank repaid annually over a period of 24 months/2 years starting November 2017, at an interest rate of 14 % one gets the total cost of credit for the ABC Bank would be Ksh236, 579.

The payments would have to be made annually and would amount to Ksh607, 290 as shown below. The calculator then adds up the annual repayments with the cost of credit factored in and allows the customer to see how much money they would have to pay in total, which in this case would be Ksh1,236,579.

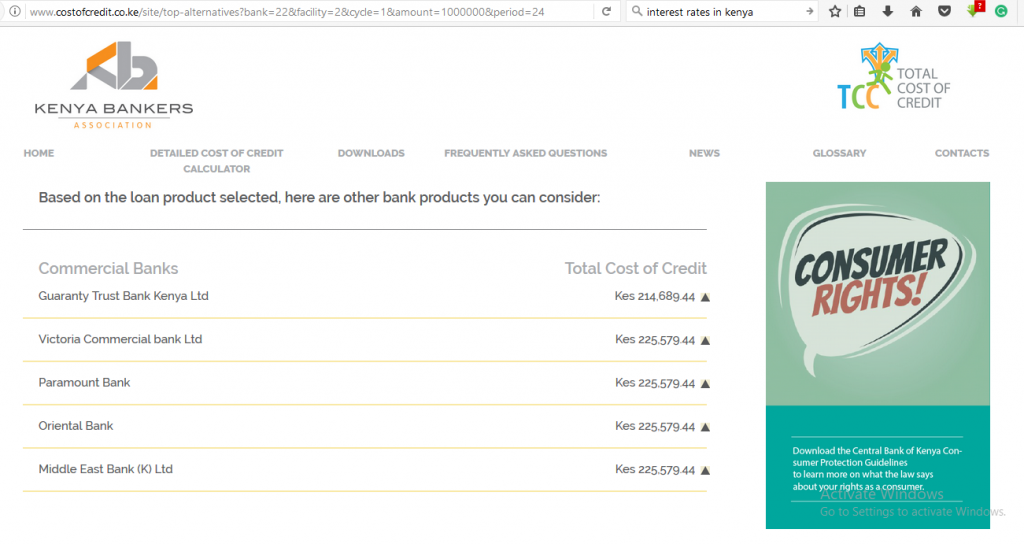

The app then provides other five cost of credit alternatives like earlier mention based on the type of loan and bank chosen.

In this case the following banks were given by the prompt:

• The Guaranty Trust Bank Kenya Ltd – which offers the cheapest cost of credit as Ksh214,689.44

• Victoria Commercial Bank Ltd – the cost of credit will be Ksh255, 579.44

• Paramount Bank Ltd – the cost of credit will be Ksh255, 579.44

• Oriental Bank Ltd – the cost of credit will be Ksh255, 579.44

• Middle East Bank Ltd – the cost of credit will be Ksh255, 579.44

Looking at the estimates suggested by the app, the best bank to visit then would be the Guaranty Trust Bank Kenya Ltd, which offers the cheapest cost of credit as Ksh214.689.44.

The total amount that one would have to pay would be Ksh1,214,689.44. The difference between Cost of Credit for ABC Bank and the Guaranty Trust Bank Kenya Ltd is Ksh21,889.56. This is a considerable amount of money that the customer will save if they choose to go with the cheapest Cost of Credit.

Leave a comment