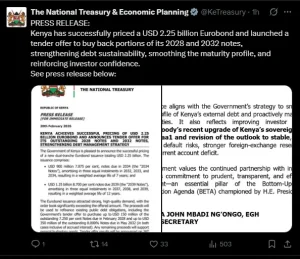

Kenya has raised Ksh 290 billion (about $2.25 billion) from international markets in a fresh Eurobond sale aimed at managing upcoming debt repayments and supporting the national budget.

The National Treasury made the announcement on Friday, February 20, 2026.

The National Treasury said the funds were raised through a dual-tranche Eurobond issuance.

“The government of Kenya is pleased to announce the successful pricing of a new dual-tranche Eurobond issuance totalling $2.25 billion,” the statement read in part.

According to the Treasury, the government issued seven-year bonds worth about Ksh 116 billion and 12-year bonds worth about Ksh 168 billion.

The money will be used to partially refinance existing Eurobonds maturing in 2028 and 2032, and to help bridge the budget deficit ahead of the 2026/2027 financial year.

The Treasury said the issuance attracted strong demand from international investors, with the order book exceeding the amount offered. Officials noted that the move is in line with the government’s plan to smooth out Kenya’s external debt maturity profile and reduce pressure from large repayments falling due within a short period.

Kenya’s return to the international capital markets comes at a time when global borrowing conditions have improved. Several African countries, including the Ivory Coast and Congo, have also tapped international markets in recent weeks as investor appetite for frontier market debt strengthens.

The government said the latest bond sale reflects improving investor confidence following a recent upgrade by Moody’s Ratings.

In January 2026, Moody’s upgraded Kenya’s sovereign rating to B3 from Caa1 and revised the outlook to stable, citing reduced near-term default risk, stronger foreign exchange reserves and improved external liquidity.

At the same time, Fitch Ratings affirmed Kenya’s B- rating with a stable outlook, noting that the country’s access to international capital markets and efforts to manage its debt profile have eased refinancing pressures.

By the end of 2025, Kenya’s foreign exchange reserves had risen to Ksh 1.57 trillion, equivalent to about 5.3 months of import cover, up from Ksh1.2 trillion in 2024.

The Treasury said the stronger reserves position has helped support the shilling and ease pressure on the balance of payments.

Under Moody’s rating scale, a B3 rating still indicates high credit risk, meaning Kenya remains exposed to economic shocks. However, the upgrade signals an improvement in the country’s ability to meet its debt obligations in the near term compared to previous assessments.

Leave a comment