Sanlam Kenya Plc has announced plans to change its name to Sanlam Allianz Holdings (Kenya) PLC as part of a wider rebranding strategy linked to the recently formed SanlamAllianz joint venture.

The Nairobi Securities Exchange-listed non-banking financial services company said it will hold a virtual Extra-Ordinary General Meeting on October 9, 2025, where shareholders will vote on the proposal.

The rebrand follows the merger between South African insurance giant Sanlam and Germany’s Allianz to form SanlamAllianz, a pan-African financial services entity operating in 26 countries with a combined equity value of more than 33 billion South African Rand, or about 2 billion Euros.

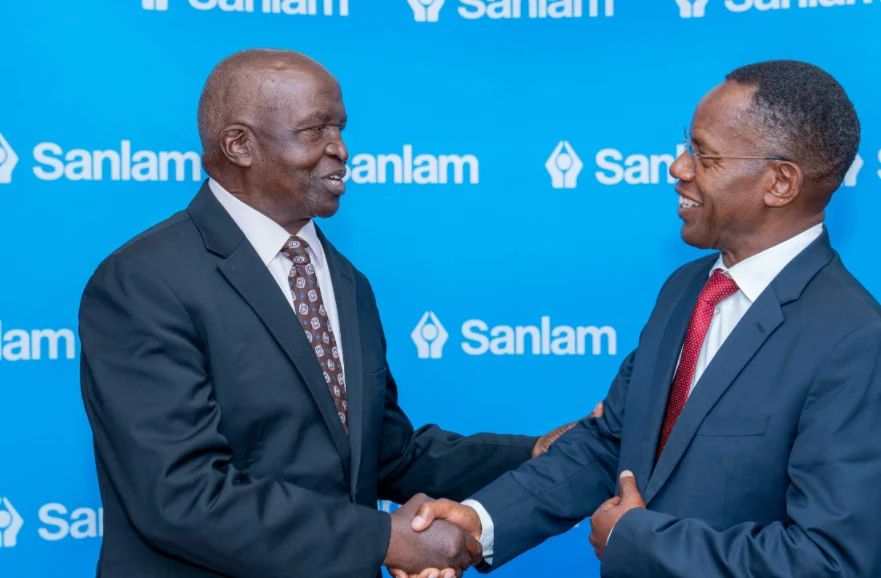

“The proposed name change is a key step in our alignment with the new SanlamAllianz brand,” Patrick Tumbo, the Group Chief Executive Officer of Sanlam Kenya, stated.

Adding;

“By formally establishing ourselves as Sanlam Allianz Holdings (Kenya) PLC, we are moving to leverage the combined expertise and financial strength of two respected and well-known global brands.”

He added that the firm would remain focused on building a resilient and client-centred business as it transitions to the new identity.

“Across Africa, Sanlam and Allianz are leveraging their mutual strengths to unlock synergies and provide clients with best-in-class, innovative insurance solutions and technical excellence. This creates value for its stakeholders through greater economies of scale, broader geographic presence, larger combined market share, and a more diversified product offering,” he said.

Ahead of the formal rebrand, Sanlam Kenya has posted steady growth in its insurance operations. For the half-year ended June 30, 2025, the company reported insurance revenue of Ksh 3.73 billion, an increase from Ksh 3.52 billion in the same period last year.

The insurer also reported strong solvency rates, with Sanlam Life Insurance and Sanlam General Insurance recording 220 per cent and 194 per cent, respectively. Total assets grew to Ksh 41.3 billion from Ksh 39.2 billion as of December 31, 2024.

The company recently completed a successful Rights Issue that raised its issued share capital to 3.22 billion shillings. Shareholders’ funds more than doubled to Ksh 3.85 billion, significantly strengthening the firm’s capital base and solvency.

Sanlam Kenya said the capital injection will help it expand and innovate while positioning itself for long-term growth under the new SanlamAllianz banner.

Leave a comment