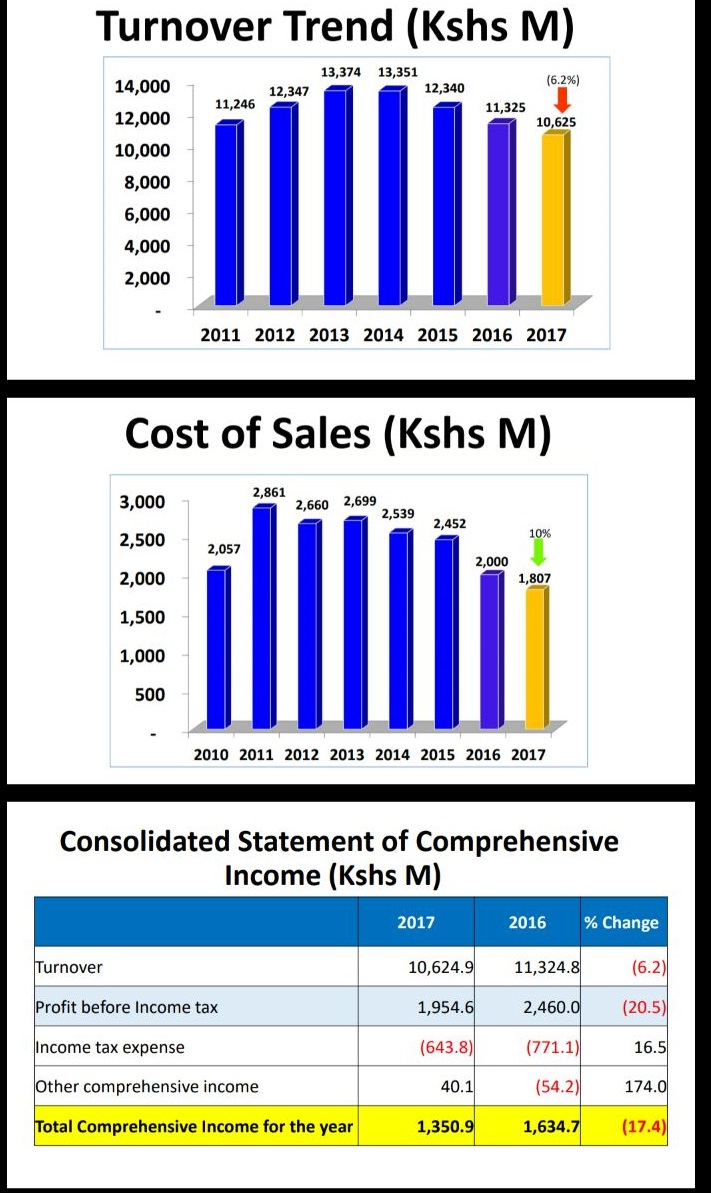

Nation Media Group today released its long-awaited financial results for last year, which showed a drop in earnings attributed to a tough business environment. Kenya’s leading media house recorded a 20.5% drop in profit before taxation (PBT) to Ksh1.95 billion, from Ksh2.46 billion in 2016.

Turnover shrank 6% from Ksh11.3 billion to Ksh10.3 billion, as advertising revenues reduced and circulation for newspapers dropped despite being an election year with higher consumption of news and advertisements. Besides, the company’s earnings were dented by the one-off restructuring cost of Ksh260 million, which included retrenching staff, and provisioning for advertising debts to the tune of Ksh300 million.

Acting CEO Stephen Gitagama presented the lower-than-expected financial performance to anxious analysts and shareholders at an investor briefing held at Stanley Hotel, explaining that this was nonetheless a strong performance given the difficult operating environment due to the prolonged electioneering period. He said most corporates were forced to cut their ad spend during the year.

“The group faced other challenges like delayed payments from the Government Advertising Agency, which did not pay for half the year and the debt is still growing,” Mr Gitagama said. He noted, however, that the company had restructured its business – through convergence and introduction of new products – to strengthen performance.

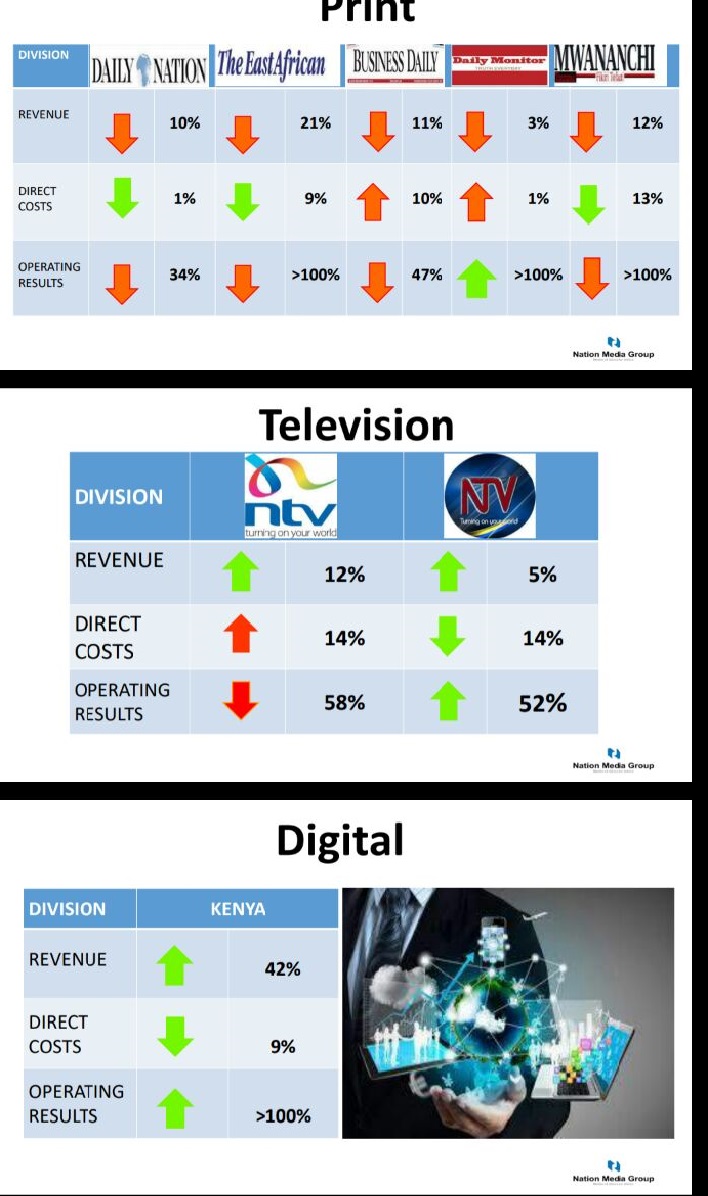

The newspaper division was hardest hit. Revenues from Daily Nation dropped 10%, The East African 21%, Business Daily 11%, Daily Monitor (Uganda) 3% and Mwananchi of Tanzania 12%. While NTV’s income grew by 12%, it was devoured by costs which went up by 14%, resulting in a 58% drop in in general operating results. Income from the digital division went up by 42%, registering the highest growth in the group during the year.

The 2017 results were achieved by Joe Muganda as CEO, under whose two and a half year tenure NMG has recorded a drop in earnings. Mr Muganda, who championed cost-cutting and closed down NMG’s radio unit and QTV, left at the end of January to join Vivo Energy. It’s not clear whether his exit was related to the company’s performance.

Despite the drop in profitability, NMG retained its dividend at the 2016 figure of Ksh10 per share in an effort to appease its skittish shareholders.

READ: Uhuru and Aga Khan in talks on media business

NMG board chairman Wilfred Kiboro said the company’s strong and sustainable financial position supported payment of the dividend. “2017 was a difficult year for businesses,” said Mr Kiboro, himself a former chief executive of NMG. “A lot of companies issued profit warnings and many, including banks that were doing so well, have recorded reduced profits.”

Mr Kiboro said the board was happy with the performance as the group continues to be profitable. He noted that the media industry was going through lean times as it reshapes in line with emerging technologies. “Ksh1.9 billion is not something to frown about,” he said as analysts present appeared not excited about the reduced profit. “Media consumption is moving away from legacy media and we are using our cash position to invest in the media of the future,” he said.

READ: Citizen retains control of radio and TV audience

He added that the government owed Nation Media over Ksh700 million dating back to 2015, with the company having provisioned about Ksh300 million in 2017 of what the state owes in it. He said the longevity of the debt has caused worries in management. “Government debt has been like a bond, as it’s perceived to be safe. But we are beginning to wonder whether it will really pay,” he said.

Mr Kiboro did a good job in restoring investor confidence in Nation Media Group, a strong brand in the industry which, he added, would continue being a market leader despite staff exits. “It’s always a good thing to refresh,” he said.

Leave a comment