CIC Life Assurance Company, a subsidiary of CIC Insurance, has introduced a new way of buying life insurance using mobile airtime. CIC Bima Credo is structured to enable consumers pay for their life insurance premiums in affordable amounts and as part of their daily mobile airtime usage, in process getting more than for times worth of insurance cover.

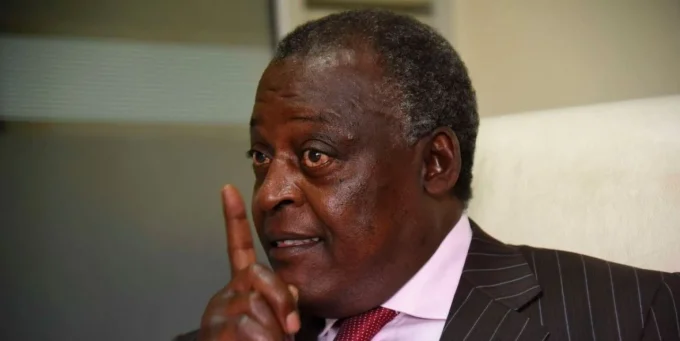

“CIC Bima Credo is the first of such services in Kenya,” said CIC Life Assurance Managing Director Ezekiel Owuor, “and as a micro-insurer, it falls within our overall corporate strategy to break down insurance into manageable and affordable premiums. With this service, we are able to expand access and simplify life insurance.”

He said the first step in rolling out the CIC Bima Credo is the Last Expense Cover, which ensures that the policy holder is fully provided for in case of demise.

One Kenyan shilling of airtime purchased from the CIC Bima Credo Till Number 181818, entitles a customer to 4.2 Kenyan shillings worth of life insurance cover, with the initial limit for Last Expense cover set at Ksh200,000. Once the customer has attained the maximum limit during the first year, any subsequent airtime purchase is rolled over to the premiums for the next year.

“We take cognizant of the fact that funerals can be expensive and may wipe away a family’s savings. The Last Expense cover is designed to give bereaved family members peace of mind as they mourn and give a descent send off to the departed one,” he added.

Also See >> Nation Media Group records major drop in profits

The service is available to Safaricom network subscribers, with a portion of the airtime they purchase going towards the Life Insurance cover premiums they sign up for. The subscriber is required to purchase airtime from the CIC Bima Credo Till number 181818 and follow the simple sign up steps.

“We appreciate that customers today are very mobile geographically and do not want to be bothered with personal visits to offices for simple transactions,” said Owuor.

[crp]

Leave a comment