Maisha Microfinance Bank has joined the Kenya Bankers Association (KBA) membership, increasing the banking industry umbrella body and financial sector advocacy group’s membership to 39 commercial banks and 8 microfinance banks. Currently, KBA’s membership represents a total asset base of more than Ksh6 trillion ($60 billion).

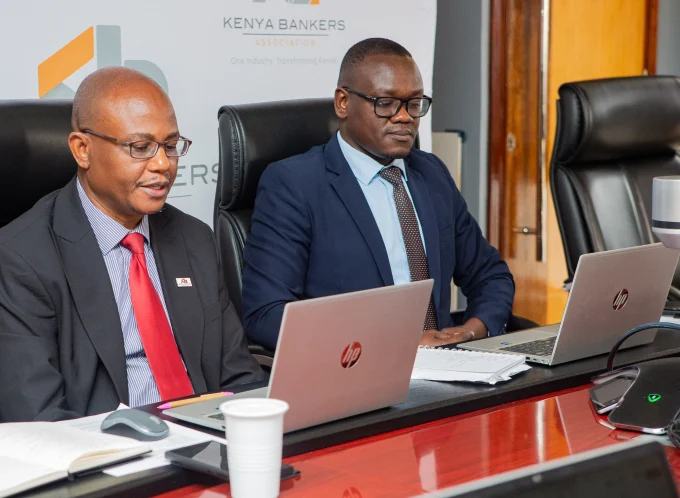

During a forum held on 30th March 2023 to welcome Maisha Microfinance Bank to the Association’s membership, KBA Chief Executive Officer, Dr Habil Olaka, highlighted the Association’s commitment to continue creating value for its member banks in line with it 2019-2023 Strategic Plan.

“We are pleased to welcome Maisha Microfinance Bank to the Association’s membership. I

have no doubt that going forward, KBA will work closely with the bank and indeed all our other member banks to enhance the industry’s contribution to the national development agenda,’’ said Dr Olaka, adding that the lender’s admission reinforces the industry’s activities towards creating a positive impact in the economy.

Maisha Microfinance Bank Chief Executive Officer, Mr Ireneus Gichana, highlighted the

importance of financial institutions in driving economic growth and the welfare of the banking public, noting that the bank was delighted to join other KBA member banks in supporting inclusive growth.

See >> Student Hostels Rake In Sh855 Million For investors

“In line with our mission, we remain committed to positively transforming enterprises and

communities through provision of digital-based financial inclusion products and services that are responsive to financial needs of individuals and businesses,” Mr Gichana said.

He said Maisha Microfinance Bank is committed to deploying cutting-edge technology to provide customer centric financial solutions and ensure they receive the best experience.

In 2013, KBA amended its constitution to allow admission of microfinance banks and

representative offices of foreign-based banks. Since then, Kenya Post Office Savings Bank

(Postbank), KWFT, Faulu, Caritas, Rafiki, Salaam, Choice and Maisha microfinance banks have joined the association.

Next >> Kenyatta Family Cashes a Fat Cheque From Bank Dividend

![Microsoft opened the ADC facility in Nairobi in March 2022. [Photo/ Microsoft]](https://businesstoday.co.ke/wp-content/uploads/2023/03/Microsoft-768x364-1-750x364-1-150x150.jpeg)

Leave a comment