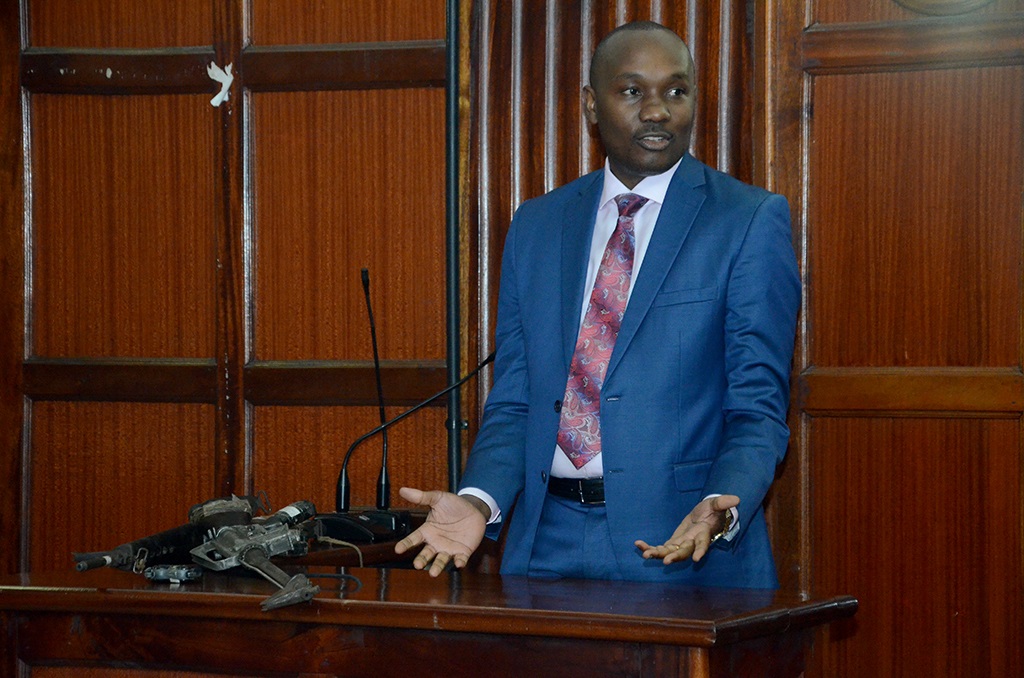

American bulk grain handler, Cargill, has been accused of attempting to recover a Sh520 million debt that flour milling tycoon Diamond Hasham Lalji guaranteed his companies more than one year before it is due, a Nairobi court has been told.

Mr Lalji says the guarantee he offered Premier Flour Mills, Maize Milling Company and Milling Corporation of Kenya for the supply of maize is due for settlement in June 30, 2018 in line with a deal he signed with Cargill in January last year and that the US firm’s attempt to recover the debt now amounts to blackmail meant to damage his reputation.

The details of the deal are part of Mr Lalji’s response to a petition Cargill has filed in court seeking to declare the businessman bankrupt for failing to repay the debt.

Cargill says it supplied Premier Flour Mills, the company that produces popular flour brands such as Chef, Nyota, Tembo, Mpishi and Highland, with maize in 2012 and that Mr Lalji has since defaulted on the agreed payment plan, forcing it to seek legal redress.

But Mr Lalji says in his response that the American firm shifted goalposts in rescinding the January 2016 agreement and filing a bankruptcy petition against him that amounts to an underhand tactic aimed at arm-twisting him.

“Premier Flour Mills, Maize Milling Company and Milling Corporation of Kenya have made various payments that Cargill had not disclosed or factored in its tabulation of the overall debt due. There is no reason for calling up the guarantee and indemnity before the agreed period of 18 months which is before June 30, 2018,” Mr Lalji says, describing the commencement of bankruptcy proceedings as an abuse of the court’s process that is intended to embarrass him.

Mr Lalji has enjoined Premier Flour Mills, Maize Milling Company and Milling Corporation of Kenya in the suit for purposes of having them prove their ability to settle the debt and have the bankruptcy petition dismissed.

Cargill, however, insists that it has negotiated a repayment plan with Mr Lalji and his firms twice, most recently in January but none has been honoured.

NEXT READ:

Leave a comment