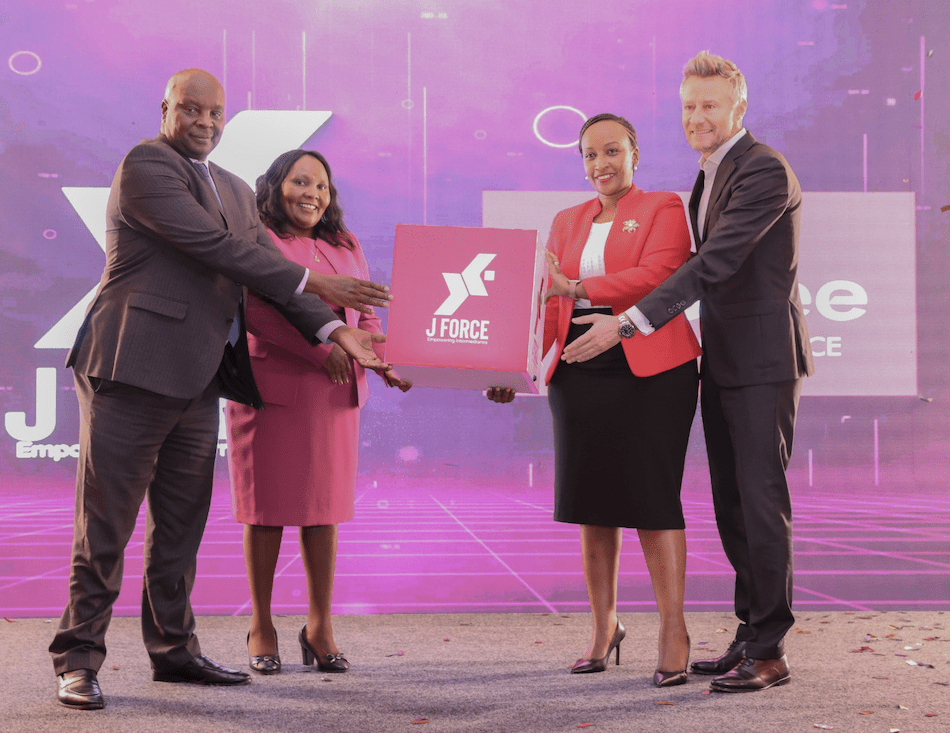

Jubilee Health Insurance has officially launched J-Force, a digital platform seen to revolutionise insurance intermediation by empowering agents, brokers, and bancassurers with seamless, paperless, and real-time insurance solutions.

J-Force is a one-stop digital solution designed to simplify and optimise the workflow of insurance intermediaries. It enables seamless onboarding, allowing agents to register new clients quickly and efficiently, while lead management tools help track and convert prospects effortlessly. With instant quotation and policy issuance, intermediaries can close deals faster through automated processes, ensuring efficiency in service delivery.

Renewals management is streamlined to keep clients covered without delays, while paperless transactions eliminate manual paperwork and administrative bottlenecks. Additionally, real-time business tracking provides intermediaries with performance dashboards and commission insights, ensuring they have full visibility and control over their operations anytime, anywhere.

Speaking at the launch, Mrs Njeri Jomo, CEO of Jubilee Health Insurance, emphasised that J-Force is more than just a tool, noting that it is a transformative force in the insurance industry. “At Jubilee Health Insurance, we recognize the critical role that intermediaries play in delivering quality insurance solutions to our customers. With J-Force, we are equipping our partners with the technology they need to work smarter, close deals faster, and enhance customer service anytime, anywhere,” she stated.

>> Jubilee Health Insurance CEO Njeri Jomo Named CEO of the Year

The launch of J-Force marks a pivotal moment in the digital transformation of insurance intermediation. As the industry shifts toward a tech-driven future, J-Force is bridging the gap between traditional face-to-face engagement and digital efficiency, ensuring intermediaries can operate at peak performance while still offering personalised client service.

Delivering the keynote address, Alice Njoroge, Director of the Insurance Institute of Kenya (IIK), underscored the critical role of digital platforms like J-Force in professional development and industry transformation.

The insurance industry is undergoing a significant shift, Ms Njoroge said, where technology is no longer an option but a necessity. “Digital platforms like J-Force not only enhance operational efficiency for intermediaries but also serve as an enabler of professional growth,” she said. “The ability to leverage data-driven insights, automate processes, and improve customer engagement is what will distinguish the next generation of successful insurance professionals.”

Juan Cazcarra, Group Chief Operating Officer at Jubilee Holdings, emphasised the company’s commitment to leveraging technology to enhance service delivery and accessibility. “Technology is not just a tool. It is the driving force behind making insurance more efficient, scalable, and inclusive. J-Force is a reflection of this vision, ensuring that intermediaries have world-class digital solutions that enable them to thrive in an increasingly fast-paced and connected world.”

> A Father Dances to Earn His A-Minus Son University Scholarship

Leave a comment