Investing is often seen as a key to unlocking financial prosperity. This article delves into whether investing can truly be life-changing, exploring its potential to build wealth, achieve financial freedom, and transform one’s financial future. Investing is game changing but not when you are a beginner and don’t know the basics. For a deep understanding of investing, see here bitalpha-ai.com now and start learning!

Wealth Building: How Investing Can Grow Your Wealth Over Time

Investing is a powerful tool for wealth building, offering individuals the opportunity to grow their financial resources over time. Unlike saving, which focuses on preserving capital, investing involves allocating money into various assets with the expectation of generating higher returns. This growth is primarily driven by the power of compounding, where the returns on an investment generate their own returns. As a result, even small amounts invested regularly can accumulate into substantial sums over the years.

One of the key aspects of wealth building through investing is the concept of time in the market. The longer the investment period, the greater the potential for wealth accumulation. This is because the effects of compounding become more pronounced over time, allowing investors to benefit from the exponential growth of their assets. For example, a modest investment in a diversified stock portfolio or a mutual fund can grow significantly over decades, outpacing inflation and contributing to real wealth creation.

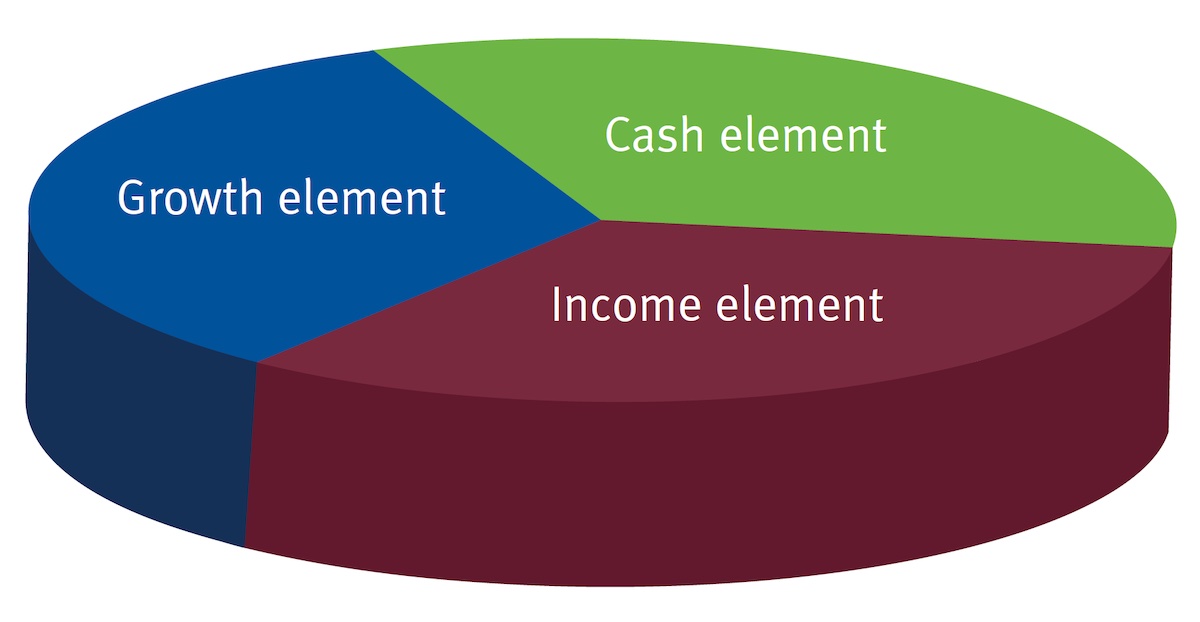

Diversification is another critical component of wealth building through investing. By spreading investments across different asset classes, such as stocks, bonds, real estate, and commodities, investors can reduce the risk of significant losses. This strategy ensures that the poor performance of one investment is offset by the better performance of others, leading to more stable and consistent growth over time.

Risk management is also essential in the wealth-building process. While higher-risk investments like stocks can offer substantial returns, they also come with increased volatility. Balancing high-risk and low-risk investments according to one’s risk tolerance and financial goals is crucial for steady wealth accumulation. This approach helps in mitigating losses during market downturns and capitalising on growth opportunities during market upswings.

In conclusion, investing is a vital strategy for wealth building, leveraging the power of compounding, time in the market, diversification, and risk management. By carefully selecting and managing investments, individuals can significantly enhance their financial security and work towards achieving long-term financial goals.

Financial Freedom: Achieving Financial Independence Through Strategic Investments

Financial freedom is a goal many aspire to, and strategic investments play a crucial role in turning this aspiration into reality. Achieving financial independence means having enough wealth to live on without relying on a regular paycheck. Investments are the key to building this wealth, as they provide the potential for capital appreciation and income generation, enabling individuals to cover their living expenses without needing to work.

The journey to financial freedom begins with setting clear financial goals and understanding one’s risk tolerance. This involves determining the desired lifestyle and the amount of money needed to sustain it. Once these goals are established, a strategic investment plan can be devised to reach them. This plan should include a mix of assets that align with the individual’s risk tolerance and investment horizon. For example, young investors with a longer time horizon may allocate a larger portion of their portfolio to stocks, which offer higher potential returns but also come with higher volatility. In contrast, those closer to retirement may prefer more conservative investments, such as bonds, to preserve capital.

A key strategy in achieving financial freedom is creating multiple streams of income through investments. This can be accomplished by investing in dividend-paying stocks, real estate that generates rental income, or fixed-income securities that provide regular interest payments. These income streams can help cover living expenses, reducing the reliance on employment income.

Reinvestment of returns is another important aspect of building wealth for financial independence. By reinvesting dividends, interest, and capital gains, investors can benefit from compounding, where returns generate their own returns. This accelerates wealth accumulation and brings the goal of financial freedom closer.

Regular monitoring and rebalancing of the investment portfolio are essential to stay on track. As personal circumstances and market conditions change, adjustments may be needed to ensure the portfolio remains aligned with the individual’s financial goals and risk tolerance.

Conclusion

In conclusion, investing holds the promise of a life-changing impact on personal finances. By understanding its principles and adopting strategic approaches, individuals can harness its power to achieve their financial goals and secure a brighter future.

Leave a comment