The global box office is poised to reach its highest level since the pandemic, fueled by a dense slate of Hollywood tentpoles and new projects from marquee directors Christopher Nolan and Steven Spielberg.

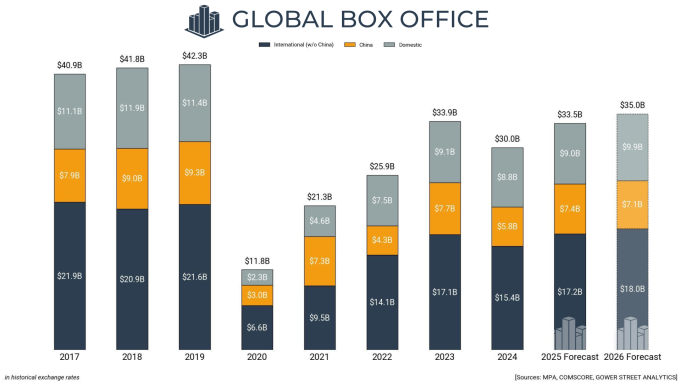

Worldwide theatrical revenue is projected to climb to $35 billion in 2026, a 5% increase over 2025 estimates, according to a report released Sunday by Gower Street Analytics. While the figure represents a post-2019 peak, it remains roughly 12% below the pre-pandemic average as the industry continues to grapple with shifting consumer habits and a volatile Chinese market.

“We predict 2026 will be the highest-grossing global year since 2019,” said Thomas Beranek, chief analyst at Gower Street. “Especially in the markets driven by Hollywood product, we expect the most significant growth.”

The recovery is being driven by what analysts describe as an “incredibly strong” calendar of intellectual property. Studios are leaning heavily on established franchises to lure audiences back to seats, with scheduled installments of Avengers, Spider-Man, Toy Story, and Star Wars expected to anchor the year’s earnings.

Market Segmentation and Regional Outlook:

North America: The domestic market is forecast to grow 11% to $9.9 billion. Despite the gains, the region continues to trail the 2017-2019 average by 14%.

International (Ex-China): Revenue is expected to hit $18 billion. Europe, the Middle East, and Africa (EMEA) are projected to lead regional growth with a 7% year-on-year increase.

China: The world’s second-largest film market remains a wildcard, with Gower Street conservatively projecting $7.1 billion in revenue, a 4% decline from 2025 levels.

Beyond sequels, the 2026 outlook is bolstered by original works from “bankable” auteurs. Christopher Nolan’s The Odyssey and Steven Spielberg’s Disclosure Day are being viewed by exhibitors as critical tests for the viability of non-franchise blockbusters.

The forecast highlights a stabilizing theatrical landscape after years of disruption caused by Covid-19 and last year’s dual Hollywood strikes. However, analysts cautioned that the $35 billion target is subject to currency fluctuations and the performance of currently “untitled” studio slots.

Gower Street, which partners with Comscore Inc. for its data, noted its 2025 forecast is currently tracking within 2% of its original projections, lending weight to the 2026 outlook as a benchmark for studio planning and investor expectations.

Leave a comment