Equity Group Holdings Plc has reported a 4.8% growth in net profit to a whooping Ksh19.8 billion for the full year ended December 31, 2018 up from the Ksh18.9 billion it posted at the same period the previous year.

The group’s strong financial performance also rubbed off on its subsidiaries with Equity Bank posting a 2.8% jump in net profit to Ksh16.8 billion, an uptick from the Ksh16.3 billion it reported at the end of its financial year in December 2017.

Conversely, the company also recorded the highest growth in profit of the three entities after posting a 29% growth in net profit to Ksh10.5 billion, Ksh2 billion more than what it raked in at the end of 2017.

The group incurred more costs during the period under review after posting Ksh38.8 billion in total operating expenses from the Ksh38.2 billion in costs it incurred the previous year.

What’s more, the group also reported an increase in it’s total operating income to the tune of Ksh2.1 billion to Ksh67.2 billion from Ksh65.1 billion during the period under review.

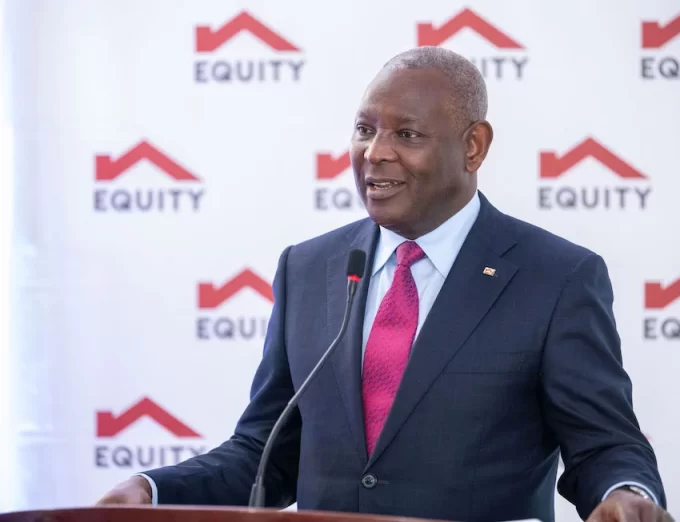

Following the performance, Group Managing Director James Mwangi has said that the board has recommended a Ksh2.00 first and final dividend per ordinary share of Ksh0.50 for the full year ended December 31, 2018 pending approval by shareholders.

They (shareholders) who will give the final green light for the payout at the group’s Annual General Meeting (AGM) slated for April 30, 2019.

{Read: Gor Mahia set to be a limited company}

“The proposed dividend will be payable on or about May 31, 2019,” says Mr Mwangi.

Ironically, the strong performance by Kenya’s second largest bank comes at a time when other listed firms are continuing to issue profit warnings with the National Bank of Kenya and Kenya Re, the latest organisations to be sucked into the Nairobi Securities Exchange (NSE) bear run.

{See also: GDC posts Sh2.1 billion pre-tax profit in 2018}

1 Comment