A life insurance license has been issued to Equity Life Assurance (Kenya) Ltd (ELAK) which is fully owned by Equity Group Insurance Holdings Limited (EGIHL), a subsidiary of Equity Group.

The license will enable ELAK to provide life insurance solutions, competing against local insurance companies that have dominated the market.

“ELAK will contribute to the trusted Equity brand by providing inclusive, affordable, innovative and accessible insurance products to a majority of Kenyans who are not utilising insurance solutions to secure much-needed protection of their lives, health and wealth, or secure their financial futures through savings solutions. Our commitment is to provide consumers with freedom and ease of access to insurance solutions, payment and placement of their insurance coverage, as well as support and advice during the life of the policy. ELAK will also ensure easy access to insurance solutions through multiple distribution channels. ELAK’s provision of insurance will be refreshingly different, innovative and very convenient,” said Ms Angela Okinda, the Managing Director and Principal Officer of ELAK.

The insurance industry in Kenya is characterized by low penetration levels, currently estimated at 2.4 percent. This has been attributed to a number of factors including poor or limited product portfolio, low or no awareness on available insurance products, low-income levels among the key consuming public, perceived low rate of returns for life insurance policies, cumbersome claim settlement procedures, lack of trust of insurance players, negative perception of providers/intermediaries and expensive premiums among others.

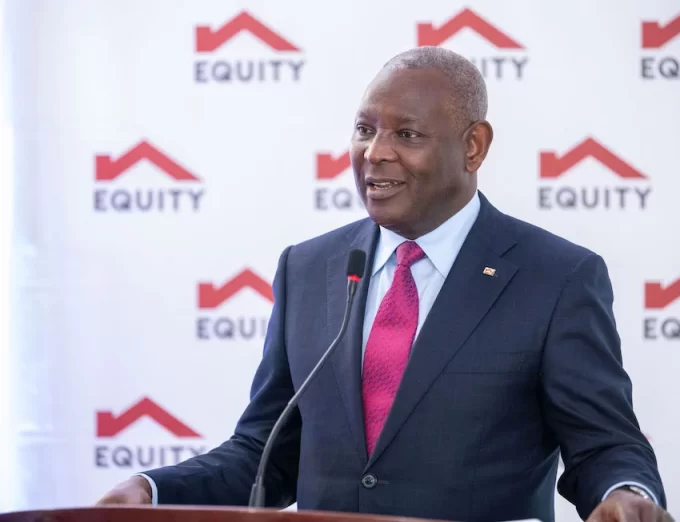

“The ELAK licence comes at a very critical time when the economy is recovering from the impact of COVID-19. Our inspiration is to offer insurance to all categories of consumers and make insurance accessible, affordable and inclusive in line with our purpose of transforming lives, giving dignity and expanding opportunities for wealth creation. We realised that the greatest threat to wealth creation is when disàster strikes and the family and entities have no fall-back plan except removing capital from their businesses to meet such expenses. The insurance business of ELAK will be based on simplicity, openness, transparency and trust,” said Dr James Mwangi, Equity Group CEO and Managing Director.

Equity Life (ELAK) is pledging to invest heavily on consumer educàtion to equip Kenyans with the knowledge to make the right decisions regarding insurance for themselves and their businesses and to embrace insurance as a key component to reliably grow their wealth, health, and livelihoods by protecting it.

While handing over the ELAK license, Commissioner of Insurance, Insurance Regulatory Authority Godfrey Kiptum said, “As the regulator, we are delighted to see Equity Group adapt to the changing demands of the market and responding to the needs and aspirations of the customers. The insurance business in Kenya is still heavily driven by the general business class and with the entry of Equity Life Assurance (Kenya) Limited into the sector, this is likely to enhance the value and distribution of life insurance in the country.”

Also speaking at the event, Insurance Regulatory Authority Chairman Abdirahin Haithar Abdi said the insurance business relies heavily on trust and Equity has a well-defined history and support from the public which is a key aspect for success in the sector.

“We congratulate Equity Group for joining the insurance sector as the newest player. Additionally, Kenya is ranked number 3 or 4 with regards to insurance penetration in Africa and many investors have taken an interest in the sector. We are happy to see a local player coming in to contribute to our growth,” said Abdi.

Dr Mwangi further added that ELAK will optimise on Equity Group’s serial innovation culture to launch inventive and substantial solutions that meet the needs of Kenyans.

“We will co-create products with Kenyans so that our offerings will be relevant and applicable to their daily lives. Further, we will ensure that the insurance solutions are easily accessible using technology on, thus giving Kenyans the freedom to access, pay and receive the insurance solution of their choice,” added Dr Mwangi.

Read: 123 Onboard Equity’s Leadership Programme In Uganda

>>> Insurers Launch App To Ease Motor Insurance Claims Process

![Scenes from the AFCON 2021 opening ceremony in Cameroon on January 9, 2022. [Photo/ Courtesy]](https://businesstoday.co.ke/wp-content/uploads/2022/01/Pictures-From-Yesterdays-AFCON-Opening-Ceremony-150x150.jpeg)

Leave a comment