Kenya Revenue Authority (KRA) is estimated to collect Kshs. 6.8 trillion over the period 2021/22 to 2023/2024 financial years.

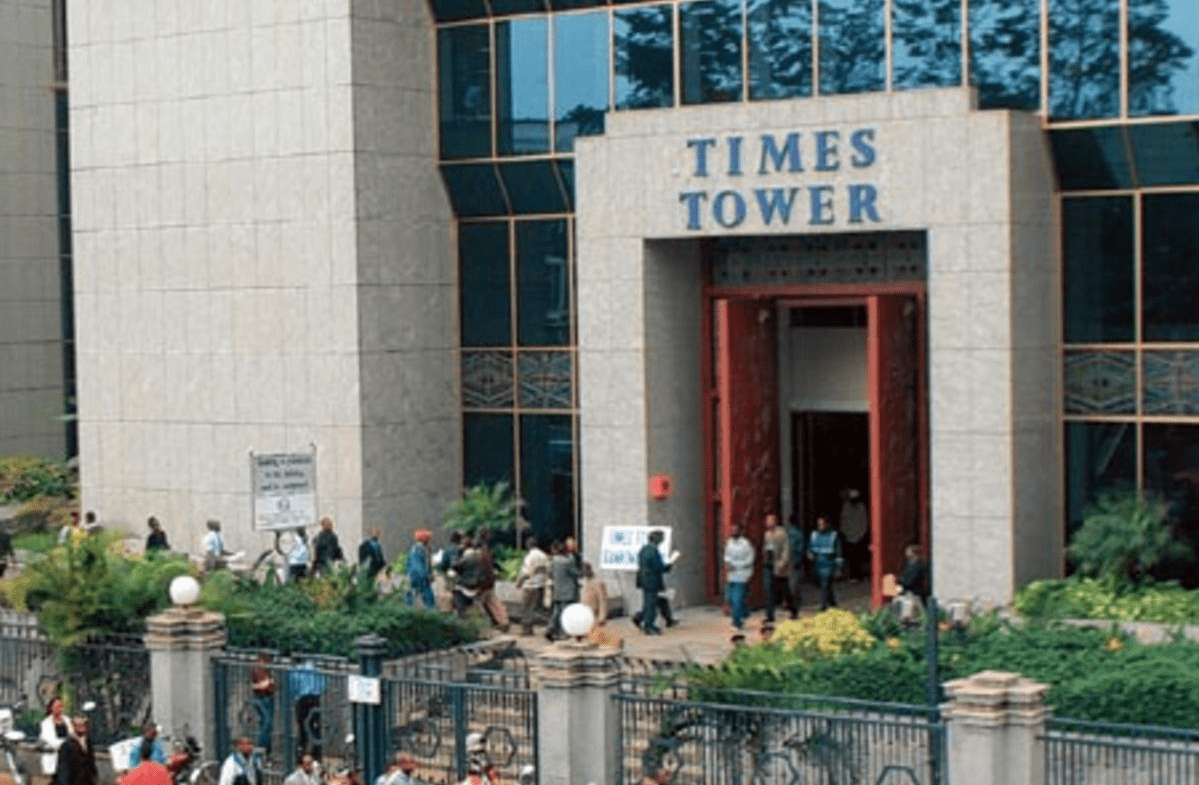

According to KRA, through its 8th Corporate Plan whose theme is Revenue mobilisation through tax simplification, technology-driven compliance and tax base expansion, that was launched today at Times Tower, Nairobi, it is expected that the exchequer revenue will rise from Kshs.1.76 trillion in 2021/22 to Kshs. 2.5 trillion in 2023/24.

Through the target revenue collection, the Authority is expected to sustain an annual average growth of 16.9 per cent over the period in which nominal GDP growth is also projected to grow at 11.2 per cent.

To increase revenue collection and achieve the set target, KRA will expand the tax base by tapping into new taxable income sources. Key focus as highlighted in the Corporate Plan will be on sectors with potential for revenue growth, such as real estate, businesses in the Turnover Tax (ToT) regime, registered companies, agriculture sector, employment sector, High Net-Worth Individuals (HNWI) and the digital economy.

The Authority aims at increasing the number of active taxpayers by an additional 2 million. Through its Customs & Border Control Department (C&BC), KRA will also focus on enabling trade across borders through facilitation of legitimate trade by effectively monitoring both land and sea borders and strengthening of the Authority’s Marine Unit. KRA will also improve pre-arrival cargo clearance using its Integrated Customs Management System (iCMS).

READ>>>>>Tax Returns: KRA Steps Up Efforts To Avoid Last-Minute Rush

Speaking during the launch of the 8th Corporate Plan, KRA Commissioner General Mr Githii Mburu said that the Authority is up to the task amidst various challenges that range from an upcoming general election in 2022, post-COVID 19 recovery measures and a growing informal sector that is hard to tax. However, strategies identified in the 8th Corporate Plan will be geared towards taxing the sector.

He said that the achievement of the 8th Corporate Plan deliverables will be supported by the six (6) thrusts: revenue mobilization, tax base expansion, simplification of the tax regime, application of cutting-edge technology, performance-oriented and ethical organization culture and strategic partnerships to bolster compliance.

CS National Treasury Mr Ukur Yatani lauded KRA for its achievements during the 7th Corporate Plan (2018/2019 -2020/2021) period. Key achievements he said include the growth of the active taxpayer base by 55 per cent, from 3.94 million in 2018/19 to 6.1 million.

Revenue collected during the plan period was Kshs. 4.849 trillion, a 21 per cent growth compared to the 6th Corporate Plan period in which total Kshs. 4.000.8 trillion was collected.

KRA registered an improved performance despite the outbreak of the COVID-19 pandemic that cropped up in early 2020 leading to the emergence of new business models, increased use of the digital platforms for transactions and growth in the hard-to-tax sectors, such as the informal sector.

Other strategies that KRA aims to implement during the 8th Corporate Plan period include; simplification of the tax regime to ease compliance and service delivery, application of cutting-edge technology in revenue mobilization, strategic partnerships to bolster compliance, facilitating and motivating staff for enhanced productivity by emphasising on ethical conduct and professionalism by all staff. Key focus area will be enhancing the staff performance management and value-based culture

The 8th Corporate Plan will be implemented in the period 2021/2022 – 2023/2024.

![Karanja accused KRA of hypocrisy as the taxman facilitated KRA with 329.4 million excise stamps for the packaging of Vienna Ice and collected Ksh7.3 billion excise tax for the Crescent Vodka used. [Photo/ File]](https://businesstoday.co.ke/wp-content/uploads/2023/02/bf-1.jpg)

![Anthony Ng'ang'a Mwaura pictured next to President William Ruto at a past function. The businessman, who primarily runs construction companies, is considered a close ally of Ruto. [Photo/ Twitter]](https://businesstoday.co.ke/wp-content/uploads/2022/11/am.jpg)

Leave a comment