African fintech start-up Chipper Cash has secured a Ksh3.2 Billion ($30 Million) Series B funding round led by Ribbit Capital with participation of Bezos Expeditions — the personal venture capital fund of Amazon CEO Jeff Bezos – to expand its products and geographic scope.

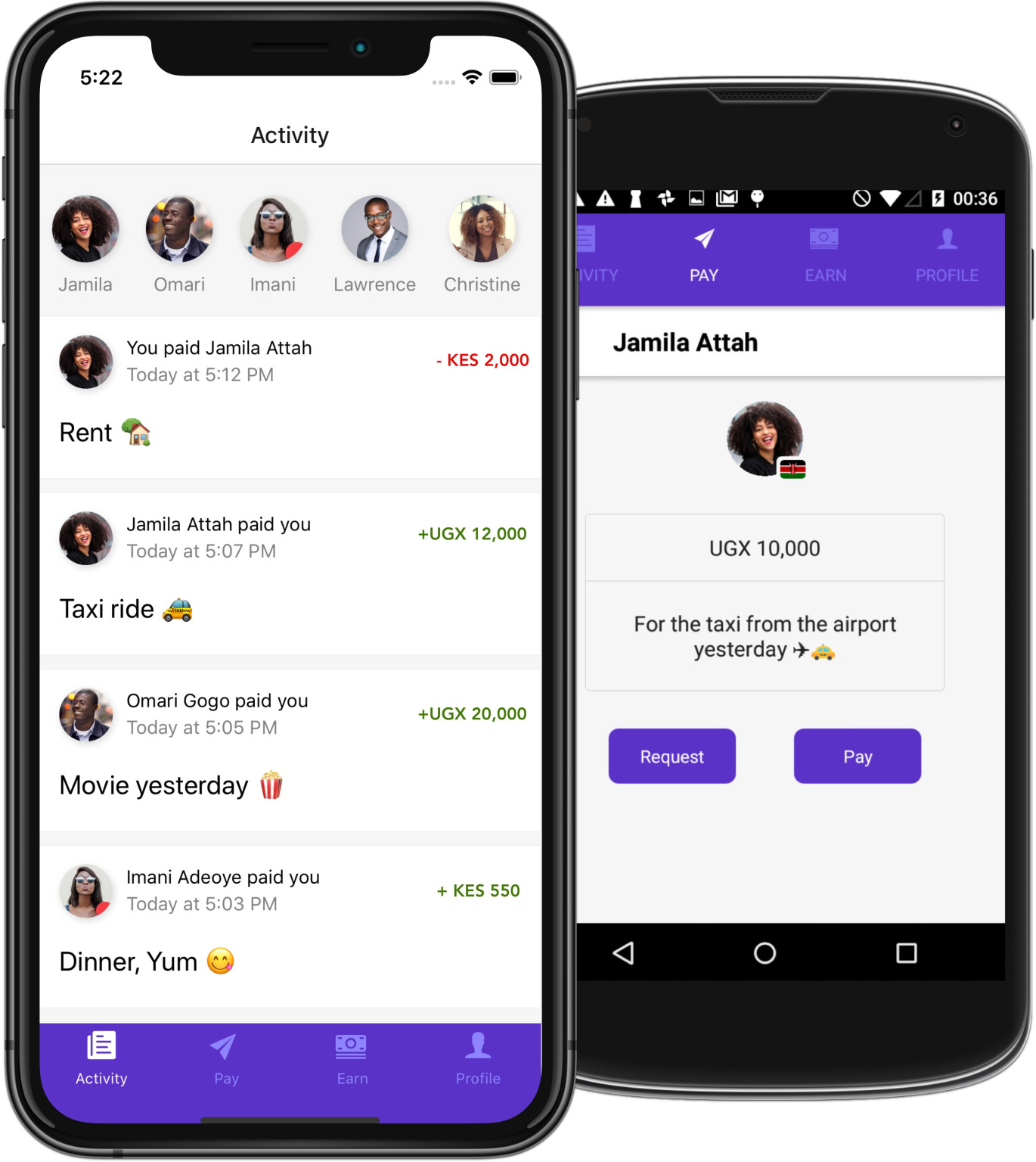

Chipper Cash, founded in 2018, is a financial technology company that builds software to enable free and instant one-on-one, cross-border payments in the African continent and abroad.

The company provides a platform for its African customers, to offer instant cross-border mobile money transfers, as easy as sending a text message. Today, Chipper Cash has already notched 3 million users on its platform and processes an average of 80,000 transactions daily.

Jeff Bezos’ backing of Chipper Cash will widen the company’s product suite through inclusion of more business payment solutions, cryptocurrency trading options, and investment services.

This is the first investment in an African startup for the venture capital fund which has also backed global tech brands such as Uber, Twitter, and AirBnB.

“We are responding to the demand from customers on our P2P platform who also have business enterprises to provide solutions to enable collection of payment for sale of goods,” Says Serunjogi, Chipper Cash’s Chief Executive Officer.

Chipper Cash also plans to use the Ksh.3.2Billion funding to grow geographical reach by additional country expansion, of which the company will announce in 2021.

Payments on Chipper Cash are currently available in Kenya, Ghana, Uganda, Tanzania, Rwanda, Nigeria, and South Africa.

Fintech continues to be Africa’s highest-funded tech sector, receiving the bulk of an estimated $2 billion in VC that went to startups in 2019. The fintech revolution in Africa has happened in less than a decade, disrupting the modus operandi in the financial services industry whilst availing financial services to those who were hitherto un-banked.

Inclusive of this funding, the company has raised a total of $43.8 (Ksh4.8 billion) million in 2020.

Leave a comment