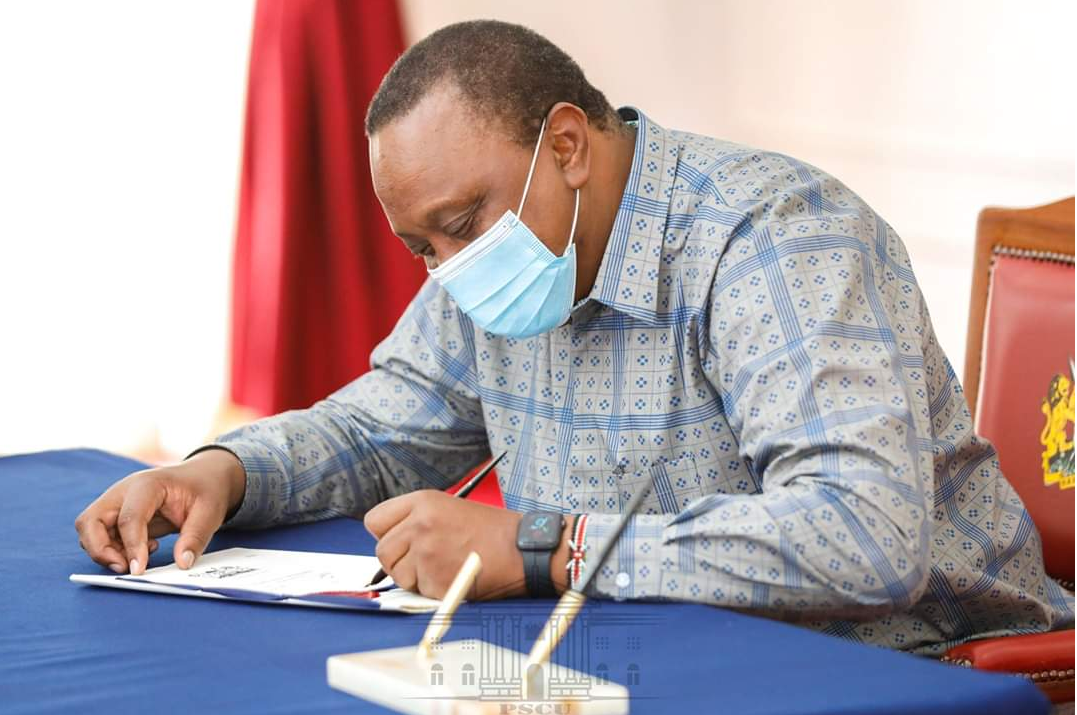

President Uhuru Kenyatta has signed into law the Tax Laws (Amendment) Bill, 2020, giving Kenyans and business tax reliefs expected to save them from the negative economic effects of Covid-19.

The new tax law, signed at State House Nairobi on 25th April, changes several statutes lowering various taxes. This sets the stage for a reduction in prices of goods and services as well as leaves houses with more disposable incomes.

New tax regime

The Amendment Bill was published on 30th March 2020 to amended Kenya tax laws including the Income Tax Act (CAP 470), the Value Added Tax Act of 2013, the Excise Duty Act (2015), the Tax Procedures Act (2015), Miscellaneous Levies and Fees Act (2016) and the Retirement Benefits Act(1997).

The amendments include the increase in the threshold for turnover tax to between Ksh1 million and Ksh50 million so as to exclude small-scale traders from the presumptive tax. The new law further lowers the turnover tax rate from 3% to 1%.

The amended law, which mainly targets low-income earners, includes a 100% Pay As You Earn (PAYE) tax relief for employees earning less than Ksh28,000 per month, up from the Ksh24,000 previously announced. Those earning above the new threshold will benefit from a PAYE tax reduction of between 30% and 25%.

Similarly, the new Kenya tax laws have revised Corporation Tax to 25% while Non-Resident Tax on Dividends has been adjusted from 10 to 15%. The amended law lowers the Value Added Tax rate from 16% to 14%, a move that is expected to lower the shelf prices of basic commodities.

Also, the new Act amends Section 38 of the Retirement Benefits Act (1997) to allow access to retirement benefits for purposes of purchase of a residential house. This is aimed at increasing homeownership in the country as envisaged in the housing pillar under Big 4 Agenda.

The Bill, which was presented to the President for signature by National Assembly Speaker Justin Muturi was passed by Parliament on Wednesday this week.

Present during the brief signing ceremony were National Assembly Majority Leader Aden Duale, National Treasury Cabinet Secretary Ukur Yatani, Solicitor General Ken Ogeto, State House Chief of Staff Nzioka Waita, National Assembly Clerk Michael Sialai and State House Deputy Chief of Staff Njee Muturi.

This came as Kenya hit 343 confirmed cases of the coronavirus, as at April 25th. President Uhuru Kenyatta announced a total of 98 people had recovered and that the death toll remained 14.

Lockdown woes

Kenya reported its first case of Covid-19 on March 13. President Kenyatta also announced the extension of nationwide dawn-to-dusk curfew as well as restrictions on movement into and outside counties most affected by Coronavirus for a further 21 days.

To cushion the poor from the economic impacts of the lockdown, President Kenyatta on Friday announced a new initiative, the National Hygiene Programme, which is set to kick off on Wednesday April 29 and run for the next 30 days and will employ 26,148 workers, and eventually grow to over a 100,000 youths.

Leave a comment